My main goal for fiscal policy is shrinking the size and scope of the federal government and lowering the burden of government spending.

But I’m also motivated by a desire for better tax policy, which means lower tax rates, less double taxation, and fewer corrupting loopholes and other distortions.

One of the big obstacles to good tax policy is that many statists think that higher tax rates on the rich are a simple and easy way of financing bigger government.

I’ve tried to explain that soak-the-rich tax policies won’t workbecause upper-income taxpayers have considerable ability to change the timing, level, and composition of their income. Simply stated, when the tax rate goes up, their taxable income goes down.

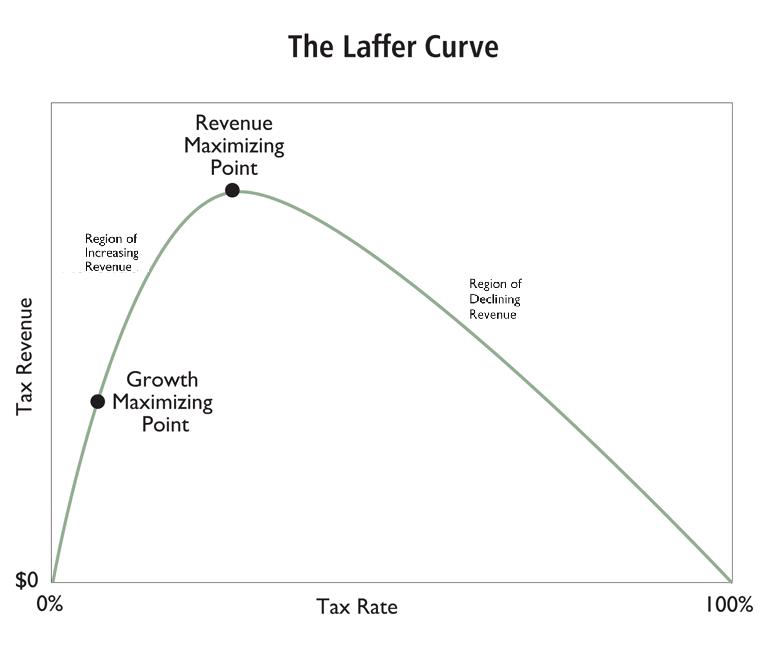

And that means it’s not clear whether higher tax rates lead to more revenue or less revenue. This is the underlying principle of the Laffer Curve.

For more information, here’s a video from Prager University, narrated by UCLA Professor of Economics Tim Groseclose.

An excellent job, and I particularly like the data showing that the rich paid more to the IRS following Reagan’s tax cuts.

But I do have one minor complaint.

The video would have been even better if it emphasized that the tax rate shouldn’t be at the top of the “hump.”

Why? Because as tax rates get closer and closer to the revenue-maximizing point, the economic damage becomes very significant. Here’s some ofwhat I wrote about that topic back in 2012.

…labor taxes could be approximately doubled before getting to the downward-sloping portion of the curve. But notice that this means that tax revenues only increase by about 10 percent. …this study implies that the government would reduce private-sector taxable income by about $20 for every $1 of new tax revenue. Does that seem like good public policy? Ask yourself what sort of politicians are willing to destroy so much private sector output to get their greedy paws on a bit more revenue.

The key point to remember is that we want to be at the growth-maximizing point of the Laffer Curve, not the revenue-maximizing point.

P.S. Here’s my video on the Laffer Curve.

Since it was basically a do-it-yourself production, the graphics aren’t as fancy as the ones you find in the Prager University video, but I’m pleased that I emphasized on more than one occasion that it’s bad to be at the revenue-maximizing point on the Laffer Curve.

Not as bad as putting rates even higher, as some envy-motivated leftists would prefer, but still an example of bad tax policy.