I’m either a total optimist or a glutton for punishment. I recently explained the benefits of “tax havens” for the unfriendly readers of the New York Times.

Now I’m defending a different form of tax competition for CNN, another news outlet that leans left. In this case, the topic is whether states can reach beyond their borders for tax revenue.

Here’s some of what I wrote about the so-called Marketplace Fairness Act that was just approved by the Senate and presumably will soon be considered by the House. I start by explaining that the powers of governments should be constrained by borders.

Let’s assume you live in Utah, Hawaii or South Carolina, and you go to Nevada for a vacation. While in Las Vegas, you spend some money in the casinos. Gambling is illegal in the state where you live, so should the cops in your home state be able to track your activities and arrest you for what happened in Nevada? The answer, needless to say, is no. Or at least it should be no. Common sense tells us that state laws should only apply to things that happen inside a state’s borders. But this sensible principle is being tossed out the window by the U.S. Senate, which has approved a proposal that would give states the ability to impose their taxes on out-of-state sellers.

I also explain that this issue isn’t about whether the Internet should be taxed. Indeed, as a fan of the flat tax, I don’t want special favors or special penalties in the tax code. Internet profits and Internet sales should face the same (ideally low) taxes as all other sectors of the economy.

Instead, the fight is really about whether a state government has the right to force out-of-state merchants to act as deputy tax collectors. If you believe that borders should limit the power of governments, the answer is no.

But that rubs politicians the wrong way.

…some governors and state legislators don’t like this system because many states don’t bother imposing any tax on sales to out-of-state consumers. And even if states levied taxes on sales to out-of-state consumers, what about the five states that don’t have any sales tax? Wouldn’t those states become “tax havens” for Internet sales? For these reasons, some politicians fret that the Internet will put competitive pressure on them to keep their sales tax rates from getting too high.

But this is exactly why politicians shouldn’t be allowed to tax beyond their borders. We want tax competition in order to limit the greed of the political class.

States with no payroll income taxes, such as Nevada, Florida, Tennessee, Texas and New Hampshire, help restrain the greed of politicians in states that have punitive income tax systems, such as California, Illinois, New York and Massachusetts. And if politicians in the high-tax states refuse to adjust their bad tax policies, then people should have the freedom to escape and earn income in other states. The same principle applies to sales taxes. If politicians in, say, Arizona are worried that consumers will go online or travel across the border to avoid the punitive sales tax, then they should reduce their sales tax rate.

So what’s the bottom line?

Politicians can choose to maintain uncompetitive tax systems, of course, but they also should be prepared to accept the consequences. I don’t think California and Illinois should try to become the France and Greece of America, but that’s something for the voters of those states to figure out for themselves. In any event, they shouldn’t have the right to force out-of-state sellers to act as deputy tax collection officials if they decide to impose bad tax policy. …To be blunt, a sales tax cartel is bad news for tax policy and bad news for privacy. Let’s limit the power of state governments so they can only screw up things inside their own borders.

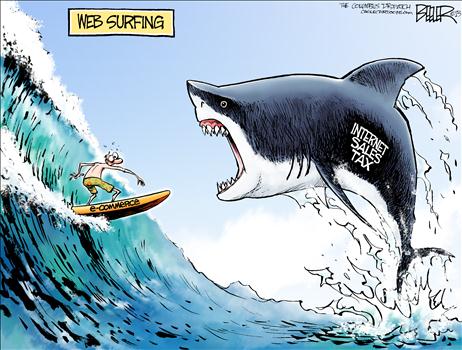

Let’s close on a light note. Here’s a clever cartoon from Nate Beeler.

I agree with the cartoon’s message, at least to the extent that onerous taxes can be very deadly to an industry. But, as noted above, I don’t want special tax-free status for the Internet.

So the ideal cartoon would show lots of surfers from all industries exercising the freedom to pick the waves with the smallest and least destructive sharks. Some might even call that federalism.