I’ve frequently argued that “third-party payer” is the main problem with the healthcare system. In simpler terms, this is the notion that a market won’t function very well if consumers think they’re spending someone else’s money.

Why be a careful consumer, after all, if someone else is picking up the tab?

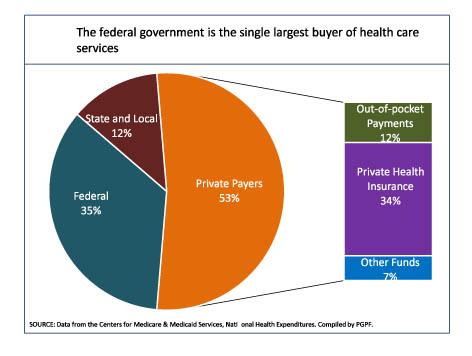

This is a pervasive problem in the United States, thanks to government programs such as Medicaid and Medicare that account for nearly 50 percent of total healthcare spending.

This is a pervasive problem in the United States, thanks to government programs such as Medicaid and Medicare that account for nearly 50 percent of total healthcare spending.

But our supposedly private insurance system also contributes to the problem. Under our convoluted internal revenue code, there’s no tax on worker compensation in the form of employer-provided fringe benefits such as health insurance. This allows workers to avoid a significant amount of both income tax and payroll tax by getting more and more of their compensation in the form of fringe benefits.

And since the average employer-provided family policy now costs about $15,000, the tax savings are significant. I like it when the government is deprived of revenue, of course, but this policy also contributes to the third-party payer problem by encouraging over-insurance.

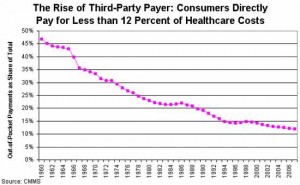

Indeed, we’ve reached the point where only 12 percent of healthcare costs are paid for directly by the consumer. No wonder the healthcare market doesn’t function very well!

Indeed, we’ve reached the point where only 12 percent of healthcare costs are paid for directly by the consumer. No wonder the healthcare market doesn’t function very well!

With this bit of background, let me explain why I’m about to say something quasi-nice about Obamacare.

Since I’ve already said the law is a fiscal nightmare and explained how it further cripples market forces in healthcare, this may be a bit of a surprise.

But even ogres and trolls occasionally have good points, and the same is true of Obamacare.

There’s a provision in the law that will cap the tax break for employer-provided health insurance. Here are parts of a New York Times report.

Say goodbye to that $500 deductible insurance plan and the $20 co-payment for a doctor’s office visit. They are likely to become luxuries of the past. …Expect to have your blood pressure checked or a prescription filled at a clinic at your office, rather than by your private doctor. Then blame — or credit — the so-called Cadillac tax, which penalizes companies that offer high-end health care plans to their employees. …Companies hoping to avoid the tax are beginning to scale back the more generous health benefits they have traditionally offered and to look harder for ways to bring down the overall cost of care. In a way, the changes are right in line with the administration’s plan: To encourage employers to move away from plans that insulate workers from the cost of care and often lead to excessive procedures and tests, and galvanize employers to try to control ever-increasing medical costs. …as many as 75 percent of plans could be affected by the tax over the next decade — unless employers manage to significantly rein in their costs.

The key passage in the above excerpt is that this change will “encourage employers to move away from plans that insulate workers from the cost of care.”

That’s just another way of describing how to deal with the third-party payer problem.

But I’m not an unqualified fan of this provision of Obamacare. I like getting rid of tax breaks, but not if it means more money for government. I want to use the money to lower tax rates, not to fatten government coffers. Needless to say, that’s not what happened with Obamacare.

Moreover, I don’t want employers figuring out how to reduce costs. Consumers need to be in charge, But if you read more of the story, it’s clear that many supporters of Obamacare don’t understand this critical distinction.

Proponents of the law say the Cadillac tax is helping bring down costs by making employers pay attention to what their health care costs are likely to be in the long run. “It’s really one of the most significant provisions” in the Affordable Care Act, said Jonathan Gruber, the M.I.T. economist who played an influential role in shaping the law.

Since Prof. Gruber played an “influential role” in the law, I guess we shouldn’t be surprised that he’s misguided even on this provision. But let’s set that aside.

I just wanted to point out that the “Cadillac Tax” would be my choice if I was forced to identify a silver lining to the dark cloud of Obamacare.

P.S. I’m not trying to rationalize a bad law. I want Obamacare repealed and I actually am reasonably optimistic that this can happen.