If I had to identify a “least-favorite” international bureaucracy, it almost certainly would be the Paris-based Organization for Economic Cooperation and Development.

The OECD doesn’t waste as much money as the United Nations, it might not cause as much macroeconomic instability as the International Monetary Fund, and it presumably doesn’t produce as much bad research as the World Bank, but it surely wins the maximum-damage-per-dollar-spent award.

- The OECD is pushing for new global rules that will result in higher taxes on the business community.

- It has allied itself with the nutjobs from the so-called Occupy movement to push for bigger government and higher taxes.

- The OECD is pushing a “Multilateral Convention” that is designed to become something akin to a World Tax Organization, with the power to persecute nations with free-market tax policy.

- It supports Obama’s class-warfare agenda, publishing documents endorsing “higher marginal tax rates” so that the so-called rich “contribute their fair share.”

- The OECD advocates the value-added tax based on the absurd notion that increasing the burden of government is good for growth and employment.

- It even concocts dishonest poverty numbers to advocate more redistribution in the United States.

All of these stories should enrage people who value economic liberty. But American taxpayers deserve to be especially irate since we pay almost 25 percent of the OECD’s lavish budget.

I’m definitely not happy about the Paris-based bureaucracy, which is why I’ve been fighting against the OECD for years. I even fought them when they threatened to throw me in a Mexican jail.

But all my previous criticisms will seem trivial when you lean about the most jaw-dropping display of hypocrisy ever displayed by a government official.

Here’s a remarkable comment from one of the top bureaucrats at the OECD.

Pascal Saint-Amans, director of the OECD’s centre for tax policy and administration, added: “The golden era of ‘we don’t pay taxes anywhere’ is over.”

Why is this statement worth highlighting? Is it because the OECD is wasting our money persecuting jurisdictions with no income taxes? That’s one of the many bad activities of the OECD, but it’s not what makes Monsieur Saint-Amans’ statement such a stunning display of tone-deaf hypocrisy.

The reason his comments are so absurd is that bureaucrats at the OECD are exempt from paying tax!

I’m not joking. The OECD’s website openly acknowledges that:

Emoluments (basic salary and allowances) are payable in arrears, with the exception of the installation allowance which is payable on taking up duty. Emoluments are exempt from taxation in most Member countries of the Organisation, including France.

Yes, you read correctly. OECD bureaucrats “are exempt from taxation.”

And when the OECD says “most Member countries,” that pretty much means every nation in the world other than the United States. But even that’s not really true since Americans who work at the OECD get extra salary to cover their tax bill to the IRS, so they wind up with just as much in their bank accounts as the workers from other nations who officially get tax-free salaries.

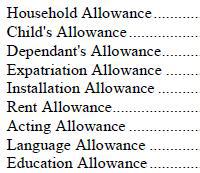

Keep in mind, by the way, that the bureaucrats also get a plethora of fringe benefits. But we’re not just talking about their gold-plated health benefits and generous pensions. OECD bureaucrats get a bevy of special allowances.

Keep in mind, by the way, that the bureaucrats also get a plethora of fringe benefits. But we’re not just talking about their gold-plated health benefits and generous pensions. OECD bureaucrats get a bevy of special allowances.

Ordinary people like you and me are expected to pay for our kids and our housing out of our paychecks. And that’s after government takes a big bite. And one of the reasons our taxes are so high is so that we can pay big salaries to tax-exempt OECD bureaucrats…and to also give them extra money for kids and housing.

Life must be nice if you’re a member of the gilded class.

Given Monsieur Saint-Amans privileged tax status, you would think that this pampered member of the bureaucratic elite would be somewhat cautious about criticizing a “golden era” when people “don’t pay taxes anywhere.”

But apparently it doesn’t bother him to demonstrate a spectacular level of hypocrisy. Indeed, I suspect that he has set the all-time record for hypocrisy in government.

What do you think? Has this OECD bureaucrat engaged in a more egregious form of hypocrisy than these other examples?

1. The bureaucrats at the IRS presumably like having more power and money to enforce Obamacare, but they don’t want to be subjected to the law.

2. Or how about rich left wingers who bleat about compassion but who are stingy with their own money.

3. And the wealthy leftists who use tax havens while trying to deny others from protecting their money.

4. There are members of the Washington elite who don’t have to live under the gun control laws they impose on others.

5. What about the politically connected business types who endorse higher taxes in exchange for favors from Washington.

6. Or the politicians who evade the taxes they impose on ordinary citizens.

7. How about Canadian politicians who support government-run healthcare but then come to America when they need treatment.

8. And it’s absurd that Europeans claim they’re more compassionate when Americans do far more to help the less fortunate.

9. To close this list on a humorous note, we also have Occupy Wall Street protesters who fight “The Man” while wanting to make “The Man” more powerful.

Maybe my views are affected by my disdain for the OECD, as well as my hostility for taxes, but I certainly think Monsieur Saint-Amans wins the prize.

However, maybe this isn’t a fair competition. After all, he was a tax collector for the French government before joining the OECD, so that gives him an almost super-human level of expertise in promoting bad policy. I’m sure he’s quite proud that there are thousands of people his country that are forced to pay more than 100 percent of their income to the government.

That being said, I’m sure he’s quite happy that he pays nothing.

P.S. Years ago, the predecessor to Monsieur Saint-Amans testified to the Finance Committee in Washington. I arranged for one of the Senators to ask Jeffrey Owens whether he thought it was hypocritical to advocate higher taxes for everyone else while simultaneously being exempt from income tax. Mr. Owens truculently replied that he could make more money if he worked in the private sector (which didn’t answer the question, but he obviously wanted people to think he was making a big sacrifice by working at a tax-free position).

Even though it was irrelevant, I’m sure what he said was true. But what’s important to understand is that he had “value” to the private sector only because of his insider connections with tax authorities in member nations. In other words, he had high value in a world of big government and crony capitalism. So you won’t be surprised to learn that Mr. Owens went to one of the Big 4 accounting firms after retiring from the OECD.

So Mr. Owens presumably is getting paid a lot of money today. And he’s finally paying tax. But he’s still part of the parasite class. Just like the former Obama Administration officials that are now getting rich serving as advisers and lobbyists helping clients deal with Obamacare. These people may not get paychecks from the government, but they sure as heck get paychecks because of government.

Which is yet another example of why big government is inherently corrupting.