Just before the end of the year, I shared some fascinating research about people dying quicker or living longer when there are changes in the death tax. Sort of the ultimate Laffer Curve response, particularly if it’s the former.

But the more serious point is that the death tax shouldn’t exist at all, as I’ve explained for USA Today. And in this CNBC debate, I argue that it is an immoral form of double taxation.

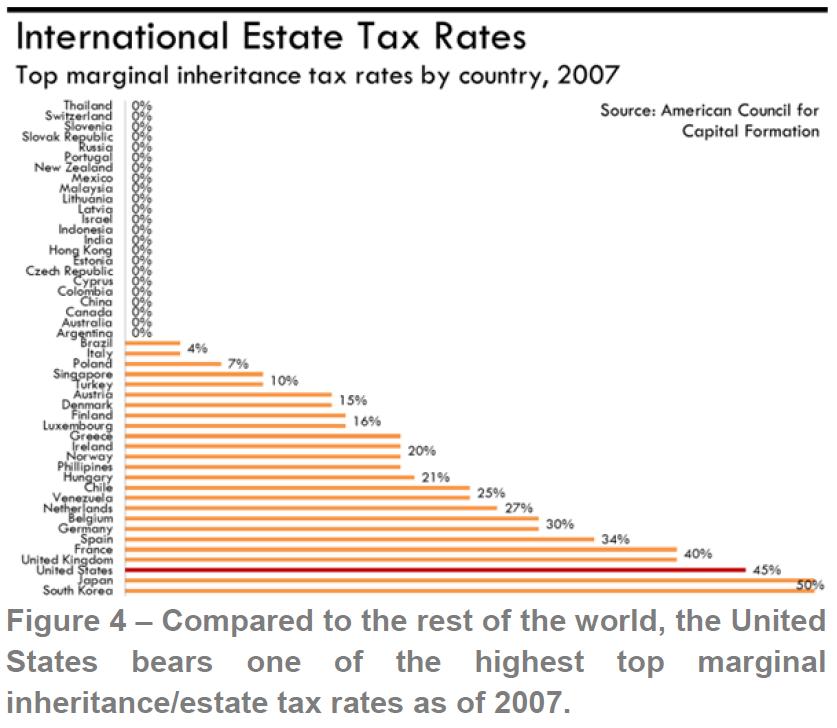

You’ll see that Jared sneakily tries to include wealth taxes and death taxes together in order to accuse me of an inaccuracy, but the chart (click to enlarge) clearly shows that there are many jurisdictions that wisely avoid this anti-competitive levy.

The data is a few years old, but it’s clear that the United states has one of the most punitive death tax systems in the world.

The data is a few years old, but it’s clear that the United states has one of the most punitive death tax systems in the world.

Unfortunately, this is a good description of many parts of our tax system. We also have the world’s highest corporate tax rate and we also have very high tax burdens on dividends and capital gains (and the tax rates on both just got worse thanks to the fiscal cliff legislation).

But probably the key difference between us is that Jared genuinely thinks government should be bigger and that the tax burden should be much higher.

Though I will give him credit. Not only does he want class-warfare tax hikes, such as a higher death tax, but he openly admits he wants to rape and pillage the middle class as well.

Not surprisingly, I argue that more revenue in Washington will exacerbate the real problem of a federal government that is too big and spending too much.