What’s the revenue-maximizing tax rate?

Since I’m interested in the growth-maximizing tax rate instead, I don’t think that’s even a legitimate question.

That being said, it seems like everyone – both on the left and on the right – should agree that it makes no sense to set tax rates so high that the government loses revenue.

That implies, after all, that the tax system is so punitive that the revenue-raising impact of the higher tax rate is more than offset by the revenue-losing impact of lower taxable income.

But if you ask five economists to identify the revenue-maximizing point, you’ll probably get nine answers.

But one thing we can say for sure is that the revenue-maximizing tax rate on Manny Pacquiao is less than 39.6 percent.

Here are some details from Yahoo Sports.

Manny Pacquiao’s chief adviser insisted Monday that the Filipino superstar’s preference is for his next bout – a fifth fight against Juan Manuel Marquez – to take place away from Las Vegas, with the off-shore Chinese gambling resort of Macau emerging as the “favorite.” The Dec. 8 fight between Manny Pacquiao and Juan Manuel Marquez was held at the MGM Grand in Las Vegas. (AP)Michael Koncz told Yahoo! Sports that the 39.6 percent tax rate Pacquiao would face if he were to fight again in the U.S. makes a fall bout in Las Vegas “a no go.” Promoter Bob Arum…said Pacquiao would not have to pay taxes if the fight takes place in casinos in either Singapore or Macau. “Manny can go back to Las Vegas and make $25 million, but how much of it will he end up with – $15 million?” Arum said. “If he goes to Macau, perhaps his purse will only be $20 million, but he will get to keep it all, so he will be better off.”

This is just an isolated example, to be sure, but I’ve already shared IRS data confirming that the rich have tremendous control over the timing, level, and composition of their income.

And just as is the case with athletes like Pacquiao (and soccer players), wealthy investors and entrepreneurs also have the ability to take advantage of tax competition by shifting economic activity to jurisdictions with better tax policy.

Indeed, these are some of the reasons why upper-income taxpayers wound up paying more money to the IRS after Reagan cut the top tax rate from 70 percent to 28 percent.

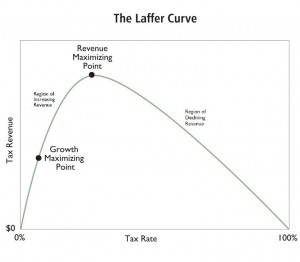

Sadly, Barack Obama seems to have a hard time grasping the relationship between tax rates, taxable income, and tax revenue – even though I prepared a simple lesson to help him understand the that there’s not a simplistic linear relationship.

So maybe this short video will help him understand the basic concept of the Laffer Curve.

Then again, maybe the President understands, but just doesn’t care. He’s already stated, after all, that he favors more punitive tax policies even if the government doesn’t collect any extra revenue.

P.S. Just in case you’re not convinced by some IRS data and the experiences of a boxer, there is lots of empirical evidence for the Laffer Curve.

- Such as this study by economists from the University of Chicago and Federal Reserve.

- Or this study by the IMF, which not only acknowledges the Laffer Curve, but even suggests that the turbo-charged version exists.

- Or this European Central Bank study showing substantial Laffer-Curve effects.

- Or this research from the American Enterprise Institute about the Laffer Curve for the corporate income tax.

- Or the United Nations admitting that the Laffer Curve limits the feasible amount of taxes that can be imposed.