With many European nations already in the midst of a fiscal crisis caused by excessive government, and with most other industrialized nations heading down the same path thanks to aging populations and poorly designed entitlement programs, this would be a good time for supposed experts to propose ways to rein in the welfare state.

But the bureaucrats at the Organization for Economic Cooperation and Development don’t get distracted by trivial details such as real-world events and evidence. The Paris-based bureaucracy is funded by governments and it predictably endeavors to keep its paymasters content by embracing proposals that increase the size and scope of government.

This attitude is quite apparent in the OECD’s new report on Inequality and Poverty in the United States. Here are some of the key recommendations.

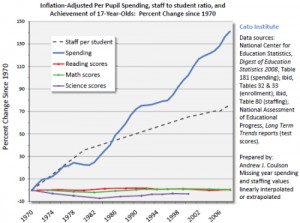

1. More education spending and centralization – The report states that “more resources need to be directed towards disadvantaged students” and that a goal should be “upgrading the teaching profession…by raising its low pay.”  Yet as illustrated by this remarkable chart, education spending in America has skyrocketed without any positive impact. Moreover, the United States already spends more than per capita than almost any other nation and gets very poor results. The OECD report also supports more centralization, urging lawmakers to “replace the local-property tax system of financing schools by state-level financing.”

Yet as illustrated by this remarkable chart, education spending in America has skyrocketed without any positive impact. Moreover, the United States already spends more than per capita than almost any other nation and gets very poor results. The OECD report also supports more centralization, urging lawmakers to “replace the local-property tax system of financing schools by state-level financing.”

2. More class-warfare taxation – The report frets about the “effectiveness of the capital income tax as a redistribution instrument” and suggests “raising the corporate income and/or capital income taxes at the personal level.” In addition to those class-warfare policies, it endorses more double taxation of income that is saved and invested, suggesting that “tax breaks to encourage the accumulation of individual private pensions could…be phased out or progressively more tightly capped.” The report even calls for making some features of the death tax more onerous, urging that “capital gains on bequeathed assets…should be taxed to avoid undermining the effectiveness of the gift and estate tax.”

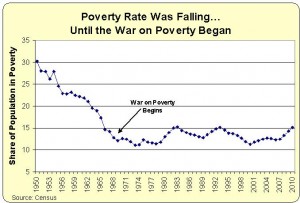

3. More welfare spending – The report complains that “cash transfer programmes…reduce poverty…less than in other OECD countries” and suggests that “government should restore the inequality-reducing power of the transfer system.”  Since welfare spending in the United States is at record levels, it’s unclear what the bureaucrats mean by “restore,” but it’s quite clear that they want more spending on programs that have undermined the fight against poverty.

Since welfare spending in the United States is at record levels, it’s unclear what the bureaucrats mean by “restore,” but it’s quite clear that they want more spending on programs that have undermined the fight against poverty.

Sounds almost as if the OECD report could have been written by a couple of interns from Obama’s reelection campaign.

Though, to be fair, the analysis in the study at times is sound. The problem is that the OECD’s bureaucrats lean strongly to the left whenever it is time to make policy recommendations.

But at least they’re not as far to the left as some of the crowd in Washington. Can you imagine this analysis being uttered by somebody associated with the Obama Administration?

…an increase in the progressivity of the taxation of capital income and wealth reduces the incomes of US households across the income distribution. Such a reform can thus, while lowering income inequality, make the majority of the population less well off. …high marginal tax rates create inefficiencies by distorting both the labour-leisure choice (i.e. by discouraging labour supply) and the choice between consuming now or in the future (i.e. by discouraging saving), with harmful effects to economic growth.

That’s a nice endorsement of lower tax rates and less double taxation, at least in theory.

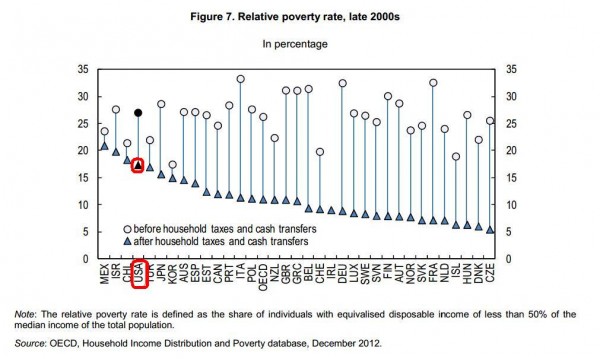

Now that I’ve said something nice about the report, I want to close by pointing out something grotesquely dishonest. The bureaucrats who authored the report assert that “relative poverty” in the United States is “among the highest in the OECD.”

They even included this chart showing that the United States has one of the worst rates of “relative poverty.”

But if you read the fine print, you may notice one itsy-bitsy detail. The chart isn’t a measure of poverty. Not even close. Indeed, the chart wouldn’t change if all of the people of any nation (or all nations) suddenly had 10 times as much income.

That’s because the OECD is measuring is relative income distribution rather than relative poverty. And the left likes this measure because coerced redistribution automatically leads to the appearance of less poverty.

Even if everybody’s income is lower!

As I explained last year, this crazy approach makes it seem as if there’s more poverty in America than in nations such as Greece, Portugal, Hungary, and Turkey.

The final insult to injury is that American taxpayers are financing the biggest share of the OECD’s budget. Sort of like having tax dollars get diverted to the research staff at the Democratic National Committee.

But with one irritating difference. OECD bureaucrats get tax-free salaries, so they don’t suffer the consequences of the policies they want to impose on the rest of us. Nice work if you can get it.

P.S. If you want other examples of OECD bias, there are plenty.

- The OECD is pushing for new global rules that will result in higher taxes on the business community.

- The OECD has allied itself with the nutjobs from the so-called Occupy movement to push for bigger government and higher taxes.

- The OECD is pushing a “Multilateral Convention” that is designed to become something akin to a World Tax Organization, with the power to persecute nations with free-market tax policy.

- The OECD supports Obama’s class-warfare agenda, publishing documents endorsing “higher marginal tax rates” so that the so-called rich “contribute their fair share.”

- The OECD advocates the value-added tax based on the absurd notion that increasing the burden of government is good for growth and employment.