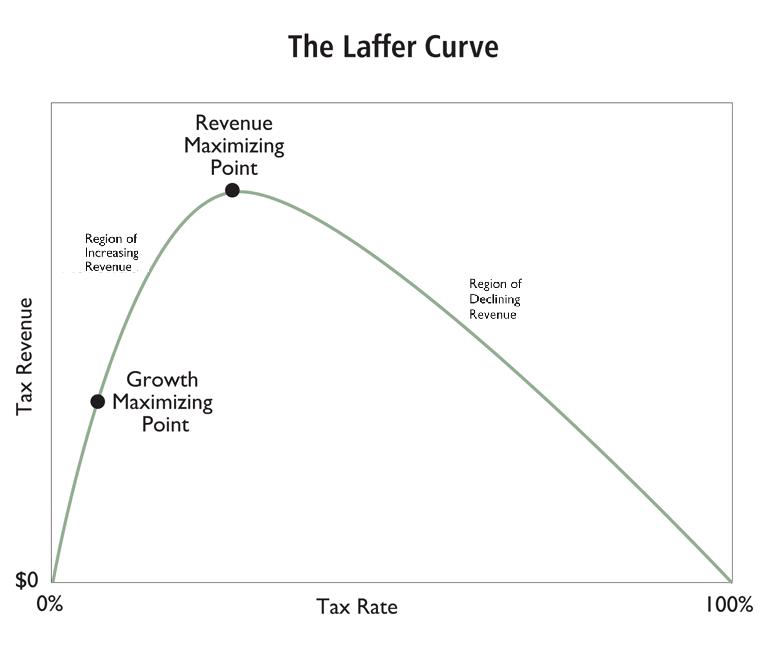

I feel like I’m on the witness stand and I’m being badgered by a hostile lawyers. Readers keep asking me to identify the revenue-maximizing point on the Laffer Curve.

But I don’t like that question. In the past, I’ve explained that the growth-maximizing point on the Laffer Curve is where enough revenue is raised to finance the legitimate – and limited – functions of government.

And one of the earliest posts on this blog explained that we don’t want to maximize tax revenue.

But I still get versions of this question, including a few that accuse me of dodging the issue.

So what the heck, I may as well give an answer to the question. But I won’t give my answer. Instead, I’ll provide the analysis of a Nobel Prize winner.

James Mirrlees won the Nobel Prize in Economics in 1996 and he’s researched this issue, starting with a left-of-center perspective.

Many economists, including Mirrlees, want to use the tax system to achieve a higher degree of equality than would otherwise obtain. This means taking a substantial amount of the additional income of high-income people, which would imply high marginal tax rates on them. But when the government imposes such high marginal tax rates on the highest-income people, it reduces the incentive of the most productive people to be productive. …Economists have long wanted to figure out the optimum, but until Mirrlees’s work no one had been able to solve it.

And what did Mirrlees find? Well, notwithstanding his own preferences, he calculated that the tax rate should be no higher than 20 percent.

Mirrlees started with no presumption against high marginal tax rates. Indeed, he has been an adviser to Britain’s Labour Party, which for decades imposed marginal tax rates in excess of 80 percent. But Mirrlees found that the top marginal tax rate should be only about 20 percent; and moreover, it should be about the same 20 percent for everyone. In short, Mirrlees’s work justified what is now known as a “flat tax,” more appropriately called a “flat tax rate.” Mirrlees wrote, “I must confess that I had expected the rigourous analysis of income taxation in the utilitarian manner to provide arguments for high tax rates. It has not done so.”

Not only a rate of 20 percent, but a flat tax!

Too bad the Labour Party politicians don’t listen to his advice. Heck, the Conservative Party politicians don’t follow his advice either.

But at least we have a rigorous estimate of the revenue-maximizing point on the Laffer Curve.

Though I hasten to add that it’s not the ideal tax rate. At the risk of being repetitive, the tax system should only fund the legitimate functions of government. For much of our history, the government only consumed about 10 percent of economic output and we didn’t need any broad-based tax. So you know where I stand.

That being said, it’s clearly destructive to have tax rates that are above both the growth-maximizing level and the revenue-maximizing level. And that’s where we stand now.

For more information, here’s my CF&P video on the Laffer Curve.

And if you want to learn specifically why Obama’s class-warfare agenda is misguided, here’s my Laffer-Curve-lesson-for-Obama post.

P.S. The Tax Foundation has estimated that the revenue-maximizing corporate tax rate is 14 percent.