I have to start this post with a big caveat.

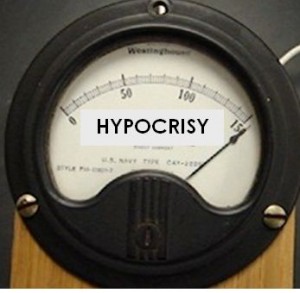

OECD bureaucrats get tax-free salaries but urge higher taxes for everyone else

I’m not a fan of the Paris-based Organization for Economic Cooperation and Development. The international bureaucracy is infamous for using American tax dollars to promote a statist economic agenda.

Most recently, it launched a new scheme to raise the tax burden on multinational companies, which is really just a backdoor way of saying that the OECD (and the high-tax nations that it represents) wants higher taxes on workers, consumers, and shareholders.

But the OECD’s anti-market agenda goes much deeper.

- The OECD has allied itself with the nutjobs from the so-called Occupy movement to push for bigger government and higher taxes.

- The OECD, in an effort to promote redistributionism, has concocted absurdly misleading statistics claiming that there is more poverty in the US than in Greece, Hungary, Portugal, or Turkey.

- The OECD is pushing a “Multilateral Convention” that is designed to become something akin to a World Tax Organization, with the power to persecute nations with free-market tax policy.

- The OECD supports Obama’s class-warfare agenda, publishing documents endorsing “higher marginal tax rates” so that the so-called rich “contribute their fair share.”

- The OECD advocates the value-added tax based on the absurd notion that increasing the burden of government is good for growth and employment.

Now that there’s no ambiguity about my overall position, I can admit that the OECD isn’t always on the wrong side. Much of the bad policy comes from its committee system, which brings together bureaucrats from member nations.

The OECD also has an economics department, and they sometimes produce good work. Most recently, they produced a report on the Swiss tax system that contains some very sound analysis – including a rejection of Obama-style class warfare and a call to lower income tax burdens.

Shifting the taxation of income to the taxation of consumption may be beneficial for boosting economic activity (Johansson et al., 2008 provide evidence across OECD economies). These benefits may be bigger if personal income taxes are lowered rather than social security contributions, because personal income tax also discourages entrepreneurial activity and investment more broadly.

I somewhat disagree with the assertion that payroll taxes do more damage than VAT taxes. They both drive a wedge between pre-tax income and post-tax consumption.

But the point about income taxes is right on the mark.

Interestingly, the report also endorses tax competition as a means of restraining the burden of government spending.

Evidence also suggests that tax autonomy may lead to a smaller and more efficient public sector, helping to limit the tax burden and improve tax compliance… Efficiency-raising effects of tax autonomy and tax competition on the public sector have also been reported in empirical research with Norwegian and German data… Tax autonomy generates opportunities to choose the level of public service provision and taxation, although in practice such “voting with your feet” seems mostly limited to young, highly educated and high-income households. Decentralised tax setting also fosters benchmarking of the performance of jurisdictions belonging to the same government level by voters, even in the absence of “voting with your feet”.

The report also notes that tax competition has reduced corporate tax rates.

Tax competition is likely to have contributed significantly to lowering corporate tax rates in Switzerland over the past 25 years. Indeed, empirical evidence shows that the responsiveness of sub-national governments to tax changes of other subnational governments (“tax mimicking”) is the strongest in the case of corporate taxation (Blöchliger and Pinero Campos, 2011). …Progressive corporate income taxes harm incentives for businesses to grow. Since growing businesses are likely to be high performers in terms of productivity, such disincentives are likely to hit high-performing businesses the most, with losses to aggregate productivity performance, which has been modest in Switzerland relative to best-performing high-income countries.

P.S. This isn’t the first time the economists at the OECD have broken ranks with the political hacks that generally control the bureaucracy. In a 1998 Economic Outlook (see page 166), they wrote that “the ability to choose the location of economic activity offsets shortcomings in government budgeting processes, limiting a tendency to spend and tax excessively.”

And in another publication (see page 1), the economists noted that “legal tax avoidance can be reduced by closing loopholes and illegal tax evasion can be contained by better enforcement of tax codes. But the root of the problem appears in many cases to be high tax rates.”

These passages sound like they could have been authored by Pierre Bessard!

P.P.S. I hasten to add that none of this justifies handouts from American taxpayers to the Paris-based bureaucracy any more than occasional bits of rationality from the World Bank (on government spending), IMF (on the Laffer Curve), or United Nations (also on the Laffer Curve) justify subsidies to those organizations.