Even though I’m a big fan of tax reform, I explained back in June that I’m not very comfortable with the “blank slate” tax reform plan put forth by Senators Max Baucus (D-MT) and Orrin Hatch (R-UT).

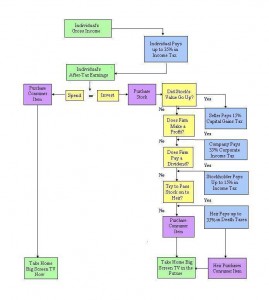

My main gripe is that they start with the assumption that there should be more double taxation of income that is saved and invested, which is contrary to the principles of neutrality in pro-growth plans such as the flat tax and national sales tax.

My main gripe is that they start with the assumption that there should be more double taxation of income that is saved and invested, which is contrary to the principles of neutrality in pro-growth plans such as the flat tax and national sales tax.

This isn’t academic nitpicking. Check out the charts in this post and see how the United States is shooting itself in the foot by imposing some of world’s highest tax rates on capital income.

So why make a bad situation even worse?

The Tax Foundation addresses this issue in a new report on what would happen if there was more double taxation of capital gains and dividends.

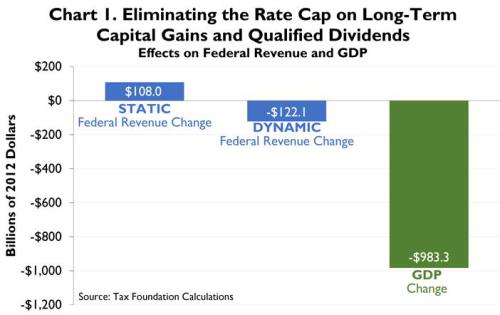

A conventional static revenue estimate, which assumes away tax-induced growth changes, might suggest the federal government would collect more revenue by taxing capital gains and dividends as ordinary income. When growth effects are added to the analysis, however, the higher revenue disappears. Ending the individual income tax’s rate cap on long-term capital gains and qualified dividends would reduce capital formation, productivity, and wages to such an extent that it would be a major revenue loser for the federal budget. Few tax increases would actually cost revenue, but the capital gains (and dividend) tax is one of them.

Here are some of the details from the study.

…the desired capital stock is extremely sensitive to its expected after-tax return. The Tax Foundation model predicts that after a several year adjustment period, the capital stock would be 16.9 percent less than otherwise, work hours would be about 1.25 percent less, and GDP would be 6.3 percent lower than otherwise. Because tax collections depend on the size of the economy, these anti-growth effects would be expected to have a negative feedback on tax collections. When our model takes the smaller economy into account, it estimates that ending the rate cap on long-term capital gains and qualified dividends would actually reduce federal revenues by $122 billion.

As you can see in the chart, estimates of annual tax hikes turn into the reality of annual revenue losses once these Laffer Curve-type effects are added to the equation.

Now let’s conduct a thought experiment. Economics is an inexact science (to put it mildly), so perhaps the Tax Foundation economists are wrong. As a matter of fact, let’s assume they dramatically overstate the economic impact of double taxation.

For the sake of simplicity, let’s do a rough cut-the-baby-in-half exercise and assume that GDP only falls by about $500, which implies that there is no loss of tax revenue.

Does that mean it’s okay to increase the double taxation of dividends and capital gains?

The answer – which should be screamed from every rooftop – is no! It makes zero sense to reduce the economy’s output and make the American people poorer. Particularly when there is no upside (and I don’t think more tax revenue is an upside, but we’ll leave that issue for another day).

For more information (at least with regards to the tax treatment of capital gains), here’s a video I narrated for the Center for Freedom and Prosperity.

P.S. I also highly recommend a primer on capital gains taxation put together by the Wall Street Journal.