If you include all the appendices, there are thousands of pages in the President’s new budget.

But the first thing I do every year is find the table showing how fast the burden of government spending will increase.

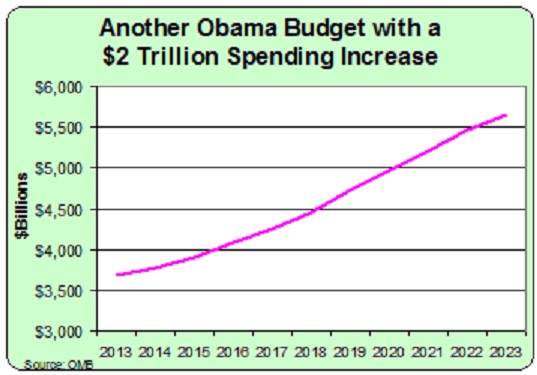

That’s Table S-1 of the budget, and it shows that the President is proposing $41 trillion of spending over the next 10 years.

But perhaps most relevant, he wants the federal budget to be $2 trillion higher in 2023 than it is today.

And this is based on the White House’s dodgy assumptions. The numbers almost certainly will look a bit worse when the Congressional Budget Office re-estimates the President’s budget.

By the way, there’s a reason the above chart looks familiar. It almost identical to the ones I put together last year and the year before. So give Obama points for consistency. Rain or shine, year in and year out, he proposes that government spending should rise by $2 trillion every time he proposes a budget.

He’s also consistent in that he demands higher taxes. Americans for Tax Reform has a list of the “Top 10″ tax hikes in the President’s budget. Most of them are based on the President’s class-warfare ideology, though he also wants to hit lower-income people with a big hike in the tobacco tax.

Another example of unfortunate consistency is that the President whiffs on entitlement reform. Unlike the House of Representatives, there’s no proposal to fix Medicare or Medicaid.

He does have a “chained CPI” proposal that would slightly reduce cost-of-living adjustments for Social Security, but that would be a substitute for the reforms that are needed to both control costs and give workers the option to boost retirement income with personal accounts.

Moreover, chained CPI is a huge tax hike, as explained by my colleague Chris Edwards.

So what’s the bottom line? Well, there isn’t one. We’re going to have gridlock for the foreseeable future. The House has passed a decent budget with some modest entitlement reform, but there’s no way that the Senate will accept that plan.

Similarly, there’s no way (knock on wood!) that the House will acquiesce to the President’s raise-taxes-but-leave-spending-on-autopilot proposal. Or the big-government plan from Senate Democrats.

So neither side will move the ball.

We’ll have some fiscal skirmishes, to be sure, with the debt limit and the FY2014 appropriations bills being obvious examples.

But nothing big will happen until either 2015 (if the Democrats win control of the House) or 2017 (if Republicans win the White House and control of the Senate).

By then, we’ll be two or fours years closer to being the next Greece.