Fighting against statism in Washington is a lot like trying to swim upstream. It seems that everything (how to measure spending cuts, how to estimate tax revenue, etc) is rigged to make your job harder.

A timely example is the way the way government puts together data on economic output and the way the media reports these numbers.

Just yesterday, for instance, the government released preliminary numbers for 4th quarter gross domestic product (GDP). The numbers were rather dismal, but that’s not the point.

I’m more concerned with the supposed reason why the numbers were bad. According to Politico, “the fall was largely due to a drop in government spending.” Bloomberg specifically cited a “plunge in defense spending” and the Associated Press warned that “sharp government spending cuts” are the economy’s biggest threat in 2013.

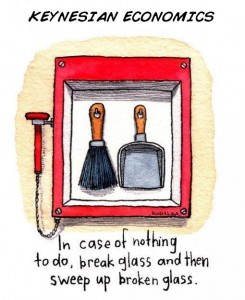

To the uninitiated, I imagine that they read these articles and decide that Paul Krugman is right and that we should have more government spending to boost the economy.

To the uninitiated, I imagine that they read these articles and decide that Paul Krugman is right and that we should have more government spending to boost the economy.

But here’s the problem. GDP numbers only measure how we spend or allocate our national income. It’s a very convoluted indirect way of measuring economic health. Sort of like assessing the status of your household finances by adding together how much you spend on everything from mortgage and groceries to your cable bill and your tab at the local pub.

Wouldn’t it make much more sense to directly measure income? Isn’t the amount of money going into our bank accounts the key variable?

The same principle is true – or should be true – for a country.

That’s why the better variable is gross domestic income (GDI). It measures things such as employee compensation, corporate profits, and small business income.

These numbers are much better gauges of national prosperity, as explained in this CF&P Economics 101 video:

The video is more than two years old and it focuses mostly on the misguided notion that consumer spending drives growth, but you’ll see that the analysis also debunks the Keynesian notion that government spending boosts an economy (and if you want more information on Keynesianism, here’s another video you may enjoy).

The main thing to understand is that GDP numbers and the press coverage of that data is silly and misleading. We should be focusing on how to increase national income, not what share of it is being redistributed by politicians.

But that logical approach is not easy when the Congressional Budget Office also is fixated on the Keynesian approach.

Just another example of how the game in Washington is designed to rationalize and enable a bigger burden of government spending.

Addendum: I’m getting ripped by critics for implying that GDP is Keynesian. I think part of the problem is that I originally entitled this post “Making Sense of Keynesian-Laced GDP Reports.” Since GDP data is simply a measure of how national output is allocated, the numbers obviously aren’t “laced” one way of the other. So the new title isn’t as pithy, but it’s more accurate and I hope it will help focus attention on my real point about the importance of figuring out the policies that will lead to more output.