Why does the Tea Party attract such vitriolic opposition, whether from Obama’s IRS or big-government Republicans like Karl Rove?

The answer is simple. People in Washington don’t like the Tea Party because this citizen uprising is making it difficult to engage in business-as-usual shenanigans.

I shared a couple of columns (here and here) back before the 2010 elections about the potential impact of the Tea Party, but it wasn’t until earlier this year that I put together some hard numbers showing that this small-government movement has made a difference.

Simply stated, Washington’s spending trajectory is still headed in the wrong direction, but we’re becoming Greece (or Portugal, Spain, Italy, etc) at a significantly slower pace.

That’s hardly libertarian Nirvana, to be sure, but let’s remember the golden rule, which is that fiscal policy is headed in the right direction so long as the private sector grows faster than the burden of government spending.

And that’s what’s been happening. Indeed, we’ve even experienced a couple of years with no growth in the size of the public sector! Here’s some of what Steve Moore wrote for today’s Wall Street Journal.

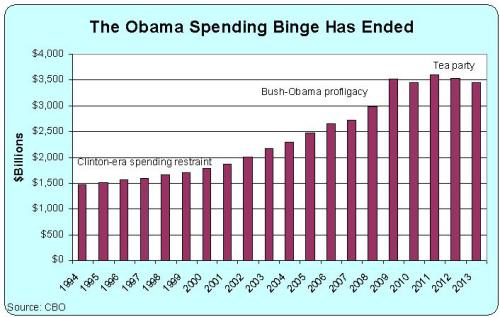

According to the Congressional Budget Office, annual outlays peaked at $3.598 trillion in fiscal 2011. After President Obama’s first two years in office, many in Washington expected that number to hit $4 trillion by 2014. Instead, spending fell to $3.537 trillion in fiscal 2012, and is on pace to fall below $3.45 trillion by the end of this fiscal year (Sept. 30). The $150 billion budget decline of 4% is the first time federal expenditures have fallen for two consecutive years since the end of the Korean War. This reversal from the spending binge in 2009 and 2010 began with the debt-ceiling agreement between Mr. Obama and House Speaker John Boehner in 2011.

This chart shows what’s happened to federal spending over the last twenty years. We’ve gone from decent policy under Clinton to profligacy last decade and now a period of fiscal responsibility.

As you can imagine, President Obama is not happy about this development, particularly since sequestration was a huge political and policy defeat for the White House.

So it’s understandable he’s trying to seduce GOPers into a budget deal that would replace sequestration with tax hikes. Steve explains this would be very misguided.

As long as Republicans don’t foolishly undo this amazing progress by agreeing to Mr. Obama’s demands for a “balanced approach” to the 2014 budget in exchange for calling off the sequester, additional expenditure cuts will continue automatically.

But even if Republicans don’t fall into Obama’s tax-hike trap, we shouldn’t overstate this victory. After all, recent spending cuts are not overly impressive when you compare them to the spending orgy that took place during the Bush Administration and the early years of the Obama Administration.

Admittedly, this fiscal progress follows the gigantic budget blowout that began with the last year of George W. Bush’s presidency and the first two years of Mr. Obama’s. In fiscal 2009 alone, federal spending surged by $600 billion. That same year, outlays as a share of GDP reached a post-World War II high of 25.2%. But by the end of this fiscal year, outlays as a share of GDP could fall to as low as 21.5%. At least for now, the great Washington spending blitz of the Obama first term is over.

Moreover, some of the “spending cuts” are simply a back-door form of revenue, an issue I explained when comparing the fiscal record of all Presidents from LBJ to Obama.

Some $80 billion of the outlay savings have come from one-time partial repayments back to the government for the hundreds of billions spent on the bailouts of banks and of Fannie Mae and Freddie Mac.

But let’s not pick too many nits. We’re making a bit of progress, which is bad news for all the interest groups feeding at the federal trough.

The sequester is squeezing the very programs liberals care most about—including the National Endowment for the Arts, green-energy subsidies, the Environmental Protection Agency and National Public Radio. Outside Washington, the sequester is forcing a fiscal retrenchment for such liberal special-interest groups as Planned Parenthood and the National Council of La Raza, which have grown dependent on government largess.

That being said, Steve notes that the short-term progress will quickly fade away if nothing is done to deal with entitlements.

…the fiscal story isn’t all rosy. The major entitlements remain on autopilot and are roaring toward insolvency. Thanks in large part to Mr. Obama’s aversion to practical fixes, the Congressional Budget Office calculates that through July of this year Social Security, Medicare and Medicaid spending are up $73 billion from just last year. This doesn’t include ObamaCare, which is scheduled to add $1 trillion of new costs over the next decade.

Remember, though, that there’s a huge difference between genuine entitlement reform and gimmicks such as price controls and means-testing that merely translate into a year or two of illusory savings.

Let’s close on an upbeat point. As Steve explains in his conclusion, the left must be glum that Obama’s reelection wasn’t the trigger for a new expansion of the welfare state.

Liberals had hoped that re-electing Mr. Obama, the most pro-spending president since LBJ, would unleash another four years of Great Society government expansion. Instead, spending caps and the sequester are squashing these progressive dreams. Welcome to the new fiscal reality in Washington.

I’ll go even farther than Steve. It’s not just that Obama’s victory didn’t translate into bigger government. I think the 2012 election was a closing chapter in an unfortunate era of big-government Republicanism.

And as illustrated by this poll showing a hypothetical contest between Reagan and Obama, the American people would welcome the chance to support a candidate who favored small government and free markets.