I routinely (some would say repetitively) argue that the burden of government spending is a drag on the economy because labor and capital are being misallocated via the political process.

My message is that we need to reduce the size of the public sector, even if we do it in a very gradual way by imposing some sort of spending cap that fulfills the Golden Rule requirement of having government grow slower than the productive sector of the economy.

That being said, a modest short-run agenda doesn’t mean we shouldn’t have bold long-run goals.

So while I’m glad the Tea Party has helped restrain government spending in the past two years, that’s just an interim step.

And I’m all in favor of bringing federal government spending back down to about 18 percent of GDP, which is where it was when Bill Clinton left office.

But why stop there? Wouldn’t it be better to dramatically shrink the public sector?

That approach certainly would be consistent with what our Founders wanted and with the first 150 years of our nation’s history.

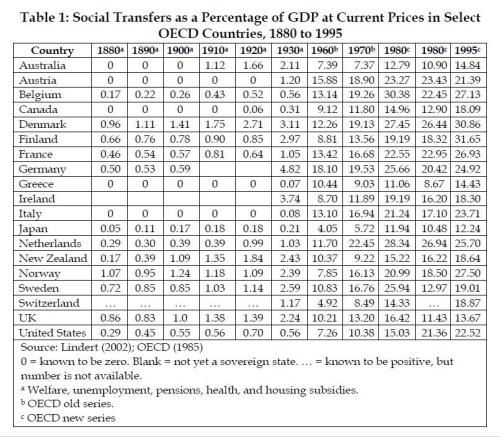

I shared some remarkable data last year showing that the public sector used to be very small. Not just in the United States, but other nations as well.

Indeed, government spending (at all levels) consumed less than 10 percent of economic output in the world’s leading nations in 1870. And even as late as 1913, the public sector only consumed an average of about 12 percent of GDP in those major western nations.

So why has government become much larger in the past 100 years? The answer, as shown by this remarkable chart prepared by Vito Tanzi, the former Director of Fiscal Affairs at the International Monetary Fund, is that the welfare state has exploded.

As you can see from the table, there was almost no welfare state at the beginning of the 1900s, and redistribution spending was minimal even as late as 1930.

But welfare-state outlays, referred to as “social transfers” in the table, have ballooned over the past eight decades. And if you’re a glutton for bad news, you should also understand that BIS, OECD, and IMF data predict major long-run troubles because entitlement programs are going to become an even bigger burden in the future.

In other words, we’re already in a deep hole because the welfare state has radically expanded, and that hole will become much deeper in almost all nations in the absence of genuine entitlement reform and effective caps on so-called discretionary spending.

Fortunately, we can make progress. Perhaps not in the next couple of years with Obama in the White House, but spending caps and entitlement reform are possible at some point in the near future.

Simply stated, the ongoing fiscal crisis in Europe is causing more and more people to understand that we can’t remain on the current path.

Our ultimate goal, however, should be shrinking government even further by restoring the Constitution’s limit on the size and scope of the federal government.

P.S. We should undo the welfare state not only because that reform would be good for taxpayers, but also because the so-called War on Poverty is bad for poor people. Redistribution creates long-run dependency because of a poverty trap that makes it more difficult to climb the economic ladder. If we really want to help the less fortunate, private charity does a far better job – and Americans (unlike Europeans) still have the genuine compassion that exists when you spend your own money.