I wrote last September that the budget plan put forward by Erskine Bowles and Alan Simpson was fatally flawed.

There were some positive features in the plan, to be sure, such as lower marginal tax rates. And I suppose it’s worth noting that the burden of government spending didn’t climb as fast under their proposal as it did in Obama’s budget, though that’s hardly an accomplishment.

But there were lots of fatal flaws in the Bowles-Simpson plan. It included a big tax increase, even though America’s fiscal problem is entirely the result of too much spending.

Moreover, the so-called entitlement reform in Bowles-Simpson wasn’t reform. It was basically a random package of means testing and price controls, and we have lots of experience showing that this approach doesn’t yield sustainable savings.

Well, Bowles and Simpson now have a new plan. Have they learned from their past mistakes? Have they responded to earlier criticisms? Have they made a more serious effort to restrain spending? To genuinely reform entitlements? To shut down useless agencies, programs, and department?

Not that you’ll be surprised, but the answer to all those questions is a big fat NO. Ryan Ellis of Americans for Tax Reform has a short analysis of the plan’s shortcomings and here are some of the highlights (though lowlights might be a better word).

The Simpson-Bowles plan headline report says it only raises taxes by $585 billion over a decade by eliminating or limiting tax deductions and credits (beyond what is needed to lower rates). …However, the plan also calls for “Chained CPI,” which the President’s FY 2014 budget says raises taxes by another $100 billion over the decade, and this plan’s Figure 21 (buried deep in the appendix) says will raise taxes by $124 billion. …There’s a third hidden tax increase, again only to be found buried in Figure 21. This is “program integrity,” which is a polite euphemism for creating a fishing expedition audit slush fund for the IRS. This is expected to raise another $30 billion by 2023. Put it all together, and the plan raises taxes by $739 billion over the next decade. …All of the tax hikes described above are just the first stage of new tax hikes in the Simpson-Bowles plan. There’s also a shadowy “Step Four” which calls for even deeper tax increases to “fix” the entitlement crisis.

In other words, the plan is taxes, then more taxes, followed by additional taxes, topped off by a promise of even more taxes.

Ryan also notes that the plan doesn’t do anything about the fiscal disaster of Obamacare and that it also exacerbates the tax code’s punitive bias by increasing double taxation of income that is saved and invested.

Gee, what’s not to love about such a proposal?

Nonetheless, a lot of people feel compelled to say nice things about Bowles-Simpson. I don’t know whether it’s because they blindly assume a “bipartisan” plan must be good.

Or perhaps they think that a plan needs to be “balanced” between tax increases and spending cuts.

I don’t have any objection to bipartisanship, assuming politicians are proposing good ideas, but let’s take a closer look at this notion of “balance.”

- Why should we raise taxes when the current fiscal mess is the result of the excessive spending of the Bush-Obama years?

- Why should we raise taxes when the long-run fiscal mess is the result of rising spending caused by poorly designed entitlement programs?

- Why should we raise taxes when the “spending cuts” we get in exchange are based on dishonest Washington budget math?

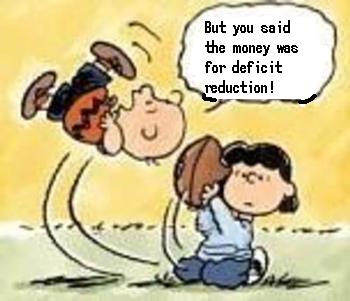

- Why should we raise taxes when bitter experience teaches us that politicians will simply raise spending?

Let’s close by elaborating on this final question. A couple of years ago, a columnist at the New York Times complained that Republicans used to be much more susceptible to getting seduced by these “balanced” budget deals.

But the reporter inadvertently showed that tax-hike deals are a mistake. It turns out that the only budget deal which actually worked was the one in 1997 that lowered taxes instead!

But the reporter inadvertently showed that tax-hike deals are a mistake. It turns out that the only budget deal which actually worked was the one in 1997 that lowered taxes instead!

I’m not making an argument for the Laffer Curve, by the way. The fiscal success of the late 1990s was a result of genuine spending restraint, as explained in this video. The lower taxes were simply a bit of icing on the cake.

My main point is that genuine fiscal restraint is far less likely to happen if tax hikes are on the table. After all, why would politicians have any incentive to do the right thing if there’s a possibility of simply siphoning more money from the economy’s productive sector?

We see the same pattern in other nations. When governments such as Canada and New Zealand actually imposed genuine limits on the growth of government spending, good things happened.

But when governments supposedly try to deal with fiscal problems by raising taxes, you get dismal results. Just look at mess in Europe, where tax increases have been nine times larger than spending cuts.