It is reported that Henry Kissinger, commenting on the Iran-Iraq war, said something to the effect that, “Too bad both sides can’t lose.” I imagine lots of people felt the same way when two of the world’s worst murderers, Hitler and Stalin, went to war in 1941.

I have the same attitude about the fiscal fight in Europe. On one side, you have “austerity” proponents of higher taxes. On the other side, you have Keynesians who think a higher burden of government spending will produce growth.

Since I want lower spending and lower taxes, I have a hard time cheering for either group. As I say in this John Stossel interview, “there’s nobody in Europe who’s actually advancing that position that…the transfer of resources from the private sector to the government…is what hurts your economy.”*

But at least the fight is entertaining, especially since former allies at the International Monetary Fund and European Commission are now in a public spat.

Here are some blurbs from a New York Times report.

…tensions…have now burst into the open with an unusual bout of finger-pointing over policies that have pushed parts of Europe into an economic slump more severe than the Great Depression and left the Continent as a whole far short of even Japan’s anemic recovery. The blame game [was] initiated by a highly critical internal I.M.F. report released this week in Washington… Speaking Friday at an economic conference in his home country of Finland, Mr. Rehn, the usually phlegmatic commissioner of economic and monetary affairs, sounded like a put-upon spouse in a messy breakup. “I don’t think it’s fair and just for the I.M.F. to wash its hands and throw dirty water on the Europeans,” he said. He was responding to assertions by the I.M.F. that the European Commission, the union’s executive arm, had blocked proposals back in 2010 to make investors share more of the pain by writing down Greece’s debt and, more generally, had neglected the importance of structural reforms to lift Europe’s sluggish economy. Simon O’Connor, Mr. Rehn’s spokesman, said the report had made some valid points, but he derided as “plainly wrong and unfounded” a claim that the commission had not done enough to promote growth through reform.

The most accurate assessment is that neither the IMF nor the European Commission have done much to promote growth. But that’s not changing now that the IMF is migrating more toward the Keynesian camp (jumping out of the higher-tax frying pan into the higher-spending fire).

A “hands-off” approach would have been the right way for the IMF and European Commission to deal with the fiscal crisis in Greece and other nations. Without access to bailout funds and having lost access to credit markets, profligate governments would have been forced to immediately balance their budgets.

This wouldn’t necessarily have produced good policy since many of the governments would have raised taxes (which they did anyhow!), but a few nations in Southern Europe may have done the right thing by copying the Baltic nations and implementing genuine spending cuts.

Let’s finish up this post by speculating on what will happen next. I’m actually vaguely hopeful in the short run, largely because governments have exhausted all the bad policy options. It’s hard to imagine additional tax hikes at this stage. Heck, even the IMF has admitted that nations such as Greece are at the point on the Laffer Curve where revenues go down.

Let’s finish up this post by speculating on what will happen next. I’m actually vaguely hopeful in the short run, largely because governments have exhausted all the bad policy options. It’s hard to imagine additional tax hikes at this stage. Heck, even the IMF has admitted that nations such as Greece are at the point on the Laffer Curve where revenues go down.

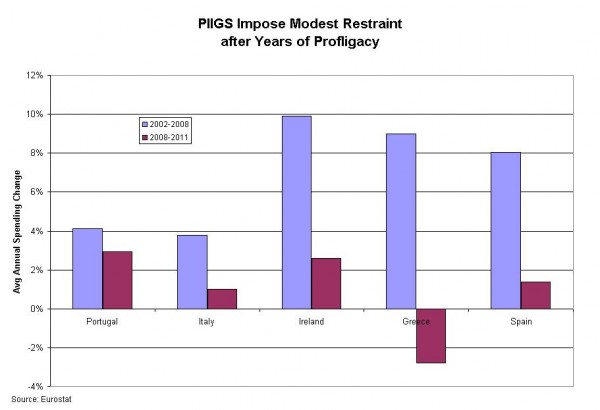

Moreover, many of these governments have slowed the growth of spending in the past couple of years, and if they can maintain even a modest bit of fiscal discipline over the next few years, that should boost growth by shrinking government spending as a share of economic output.

But continued spending restraint is vital. The burden of government spending is still far too high in the PIIGS nations, even when merely compared to pre-crisis spending levels.