I can say with great confidence that government bureaucrats are overpaid compared to people in the productive sector of the economy.

Why am I sure that this is true, particularly when the so-called Federal Salary Council claims bureaucrats are underpaid?

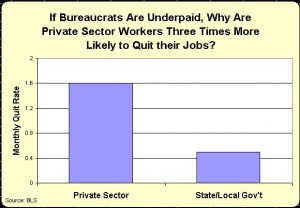

For the simple reason that the “job opening and labor turnover” data from the Department of Labor is the best way to measure whether a group of workers is overpaid or underpaid.

For the simple reason that the “job opening and labor turnover” data from the Department of Labor is the best way to measure whether a group of workers is overpaid or underpaid.

And you probably won’t be surprised to learn from this data that bureaucrats at the federal, state, and local level are only about 1/3rd as likely to quit their jobs as workers in the private sector.

They’re less likely to leave their jobs, needless to say, because they generally get paid more than they’re worth.

But just in case you think this data is unconvincing, let’s look at some additional research.

Sita Slavov of the American Enterprise Institute explores this topic in an article for U.S. News & World Report.

…studies show that, while the salaries of public sector workers are roughly in line with those paid in the private sector, public sector workers receive substantially more generous fringe benefits, such as pensions, health benefits, vacation and job security. …Why are public sector workers so highly compensated? And, why is their compensation so heavy on benefits? Workers certainly value benefits, such as access to group health insurance, and many benefits are tax advantaged. But do public sector workers really value these benefits more than private sector workers? Edward Glaeser and Giacomo Ponzetto have attempted to address these questions in a recent National Bureau of Economic Research working paper entitled “Shrouded Costs of Government: The Political Economy of State and Local Public Pensions.” The authors present a formal model in which public sector compensation is determined by a political process that pits politicians against each other in a competition for votes. They show that this political process results in a public sector compensation package with generous benefits.

In other words, bureaucrats are over-compensated, and much of their excess compensation is in the form of generous fringe benefits.

The new study cited by Sita looks at why this happens.

Public sector workers have an information advantage over other voters. In particular, they are better informed about their own compensation packages. Moreover, this information advantage is more pronounced for benefits than salary. This is plausible because information about public sector salaries is available to the general public… In contrast, information about public sector pensions is less widely available, and because of complications involved in valuing future pension benefit promises, it is also more difficult to interpret. As a result, politicians propose generous public sector compensation that is tilted towards benefits rather than salary. A politician who tries to scale back public sector benefits will lose support from public sector voters (who are hurt by the benefit cut) without gaining much support from other voters (who gain from lower taxes but are poorly informed).

My interpretation of these findings is that politicians and bureaucrats basically conspire to rip off taxpayers.

In exchange for campaign contributions and other forms of political support, the politicians give the bureaucrats excessive compensation. But they make it difficult for taxpayers to figure out how they’re getting robbed by concentrating a big share of the excess in harder-to-measure fringe benefits.

Another advantage of that approach, by the way, is that the bill for all the retiree benefits doesn’t come due until some point in the future, by which time the politicians who put taxpayers on the hook often have retired or moved on to some other position.

But these promises do translate into real costs sooner or later, as taxpayers have painfully learned in places such as diverse as California and Greece.

Though, to be fair, governments get into fiscal trouble because they also make irresponsible commitments to all workers, including those in the private sector. America’s long-term fiscal crisis, for instance, is because of poorly designed entitlement programs.

Bu this isn’t an excuse to do nothing. It just means we have to reform entitlements and also trim back the excessive compensation for the bureaucracy. This video elaborates.