Sigh. I feel like a modern-day Sisyphus. Except I’m not pushing a rock up a hill, only to then watch it roll back down.

Compared to educating journalists about fiscal policy, this is an easy task

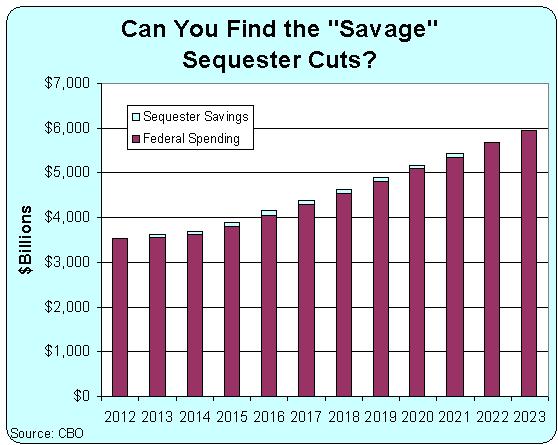

I have a far more frustrating job. I have to read the same nonsense day after day about “deep spending cuts” even though I keep explaining to journalists that a sequester merely means that spending climbs by $2.4 trillion over the next 10 years rather than $2.5 trillion.

The latest example comes from the New York Times, which just reported about “deep automatic spending cuts that will strike hard” without bothering to provide a single concrete number about spending levels in any fiscal year.

Yes, you read correctly. A story about budget cuts did not have any numbers for spending in FY2013, FY2014, or any other fiscal year.

So, for the umpteenth time, here are the actual numbers from the Congressional Budget Office showing what will happen to spending over the next 10 years if we have a sequester.

I don’t mean to pick on the New York Times. Yes, the self-styled paper of record has been guilty in the past of turning budget increases into spending cuts, but the Washington Post is guilty of the same sin, having actually written in 2011 that reducing a $3.8 trillion budget by $6 billion would “slash spending.”

And the NYT story actually has some decent reporting on how Republicans so far have (fingers crossed) avoided the tax-increase trap that Obama thought the sequester would create.

But one would still like to think that Journalism 101 teaches reporters to include a few hard facts when writing stories. Particularly if they’re going to use dramatic adjectives to describe what supposedly will happen.

Anyhow, this is just part of a larger problem. As I explained in these John Stossel and Judge Napolitano interviews, the politicians and interest groups have given us a budget process that assumes ever-increasing spending levels, which then allows them to make hysterical claims about “savage” and “draconian” cuts whenever spending doesn’t rise as fast as some hypothetical baseline.

This is why almost nobody understands that it’s actually relatively simple to balance the budget with a modest bit of spending restraint. My goal is reducing the burden of government spending, not fiscal balance, but it’s worth noting that we’d have a balanced budget in just 10 years if spending grew by “only” 3.4 percent annually.