For those who haven’t followed this issue, Kenneth Rogoff and Carmen Reinhart wrote an influential paper in 2010 arguing that government debt above 90 percent of GDP was associated with weaker economic performance.

It turns out that the Rogoff and Reinhart made a mistake in their excel spreadsheet and this error was publicized in a recently unveiled article by three other economists.

This has led to a renewed debate about “austerity,” with R&R cast in the role of fiscal hawks and various critics saying that the mistake in their paper discredits that approach and that it’s time for Keynesian policies.

If you’re interested in the broader debate, here’s what Rogoff and Reinhart wrote in the New York Times to defend themselves, and here’s Paul Krugman’s criticism.

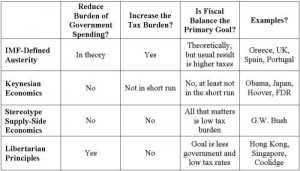

But if you want to know my opinion, I’m not a fan of either side. Unlike the Keynesians, I don’t think debt is good for growth. But I also think it doesn’t make sense to myopically focus on red ink.

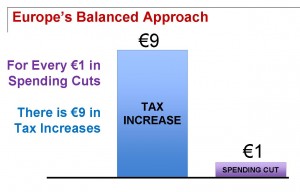

Which explains why I’m very frustrated by the debate in Europe. On one side, you have the Keynesians advocating higher spending and on the other side you have “austerians” advocating higher taxes.*

Which explains why I’m very frustrated by the debate in Europe. On one side, you have the Keynesians advocating higher spending and on the other side you have “austerians” advocating higher taxes.*

No wonder I want both sides to lose!

As I’ve repeated over and over again, the real fiscal problem in most nations is the size of government. Excessive government spending is bad for prosperity, regardless of whether it is financed by taxes or borrowing.

To be sure, governments can accumulate so much debt that investors will get suspicious and demand very high interest rates before lending more money (sometimes referred to as an attack by “bond vigilantes”).

But it’s important to realize that debt is the symptom. The underlying disease is a bloated public sector. That’s true in Greece, Spain, Italy, and other nations that have had trouble borrowing money.

By the way, it’s also true in nations such as France and Belgium. Those countries also have governments that are far too big. They haven’t been hit (at least not yet) by the bond vigilantes, but they’re suffering from economic stagnation as well.

In other words, deficits are bad, but the real problem is spending. I elaborate in this Center for Freedom and Prosperity video.

The wise fiscal policy, needless to say, is to follow Mitchell’s Golden Rule. If the burden of government spending grows slower than the private economy, any nation can climb out of a fiscal ditch. Especially if they lower tax rates and avoid class-warfare tax policy.

*In theory, the “austerians” ” also advocate less spending, but you won’t be surprised to learn which option politicians select when given a choice between higher taxes and less spending.

*In theory, the “austerians” ” also advocate less spending, but you won’t be surprised to learn which option politicians select when given a choice between higher taxes and less spending.

P.S. You also won’t be surprised that Paul Krugman doesn’t do his homework when he writes about “austerity” in Estonia and the United Kingdom.

P.P.S. Please do not confuse “austerian” economics with “Austrian economics.” The former is a political rationale for tax hikes. The latter is a sensible school of economic thought.