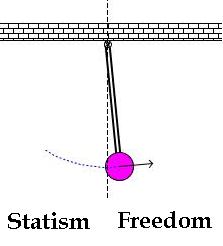

Folks, the pendulum is swinging in the right direction.

In recent weeks, I’ve shared a bunch of examples to support my hypothesis that libertarians, small-government conservatives, and classical liberals are finally making some progress.

In recent weeks, I’ve shared a bunch of examples to support my hypothesis that libertarians, small-government conservatives, and classical liberals are finally making some progress.

This trend actually started with the fiscal cliff, though that was simply a smaller-than-expected defeat.

Since then, we’ve enjoyed victories on the sequester, the IMF, and dynamic scoring. I’ve also posted some evidence showing that the Tea Party has made a positive difference and specifically shared data showing that the burden of government fiscal policy has been reduced since the 2010 elections.

Well, here’s another feel-good story. A powerful Committee Chairman in the House of Representatives realizes that being pro-market is not the same as being pro-business. Hallelujah!

The Wall Street Journal reports:

During Jeb Hensarling’s first congressional bid, a man at a campaign stop in Athens, Texas, asked the Republican if he was “pro-business.” “No,” the candidate replied, drawing curious stares from local business leaders who had gathered to hear him speak, a former Hensarling aide recalled. “I’m not pro-business. I’m pro-free enterprise.” Now, more than a decade later, that distinction has Wall Street on edge. The new chairman of the House financial services committee wants to limit taxpayers’ exposure to banking, insurance and mortgage lending by unwinding government control of institutions and programs the private sector depends on, from mortgage giants Fannie Mae and Freddie Mac to flood insurance. Banks and other large financial institutions are particularly concerned because Mr. Hensarling plans to push legislation that could require them to hold significantly more capital and establish new barriers between their federally insured deposits and other activities, including trading and investment banking. …In interviews, a half-dozen industry representatives expressed some level of anxiety about Mr. Hensarling’s legislative agenda.

So, the cronyists are “on edge” and feeling “anxiety.” Gee, just breaks my heart.

And it’s not just Rep. Hensarling that is singing from the right song sheet.

Earlier this month, all 45 Senate Republicans voted for a symbolic measure aimed at banks with more than $500 billion in assets. The amendment, offered by Sens. David Vitter (R., La.) and Sherrod Brown (D., Ohio), sought to eliminate any subsidies or other advantages enjoyed by the biggest financial institutions because investors expect the government to prevent them from collapsing. …Most congressional Republicans believe the changes enacted in the wake of the 2008 financial crisis—principally in the Dodd-Frank financial reform bill—enshrined the notion that the biggest institutions are “too big to fail” because they guaranteed the government would step in to prevent the most sprawling firms from going under.

To be sure, many of these same politicians voted for TARP, so I’m not under any illusions that they’ve become committed supporters of genuine capitalism.

Putting taxpayers before Wall Street

Though Hensarling did vote the right way, so I’m confident that he understands that insolvent banks should be liquidated rather than bailed out.

Too bad folks in the Bush Administration didn’t understand this simple principle of free markets.

Here are some more details from the article about Hensarling’s commitment to economic liberty.

Mr. Hensarling has been a vocal critic of taxpayer backstops for the private sector. He voted against the Wall Street rescue package in the fall of 2008 and supported measures to ease the importation of prescription drugs. He even picked a fight with one of the largest employers in his backyard—American Airlines—by supporting initiatives to allow more long-distance flights out of Dallas’s Love Field, the home base for rival Southwest Airlines. Now, his other potential targets include: the Export-Import Bank of the U.S., which makes loans to American companies that do business overseas, and the Terrorism Risk Insurance Act, a temporary backstop created in the aftermath of 9/11 to insure construction projects. The latter measure expires at the end of 2014, unless Mr. Hensarling’s committee acts to extend it. “In every jurisdictional area that I can get my fingers on, I want to move us away from the Washington insider economy,” he said. Mr. Hensarling sharpened his free-market views when he studied economics under former Sen. Phil Gramm at Texas A&M University.

I’m especially happy to see that he wants to end the corrupt system of subsidies from the Export-Import Bank, which is a typical example of big businesses being anti-free market.

So what does all this mean? Perhaps not much in the short run, particularly with Obama in the White House and Tim Johnson of South Dakota chairing the Senate Banking Committee.

In the long run, though, this is a positive sign. Our prosperity and liberty depend on small government and free markets, so we need at least a few lawmakers who understand that there shouldn’t be any special favors for big interest groups.