The half-joking response to the question in the title of this post is that policymakers should look at what’s happening in poorly run jurisdictions such as California, France, Illinois, and Greece – and then do just the opposite.

In other words, steer clear of punitive class-warfare tax rates and make sure to control the burden of government spending.

But there’s an even simpler rule that is very correlated with good fiscal policy, at least at the state level. Governments should not impose income taxes.

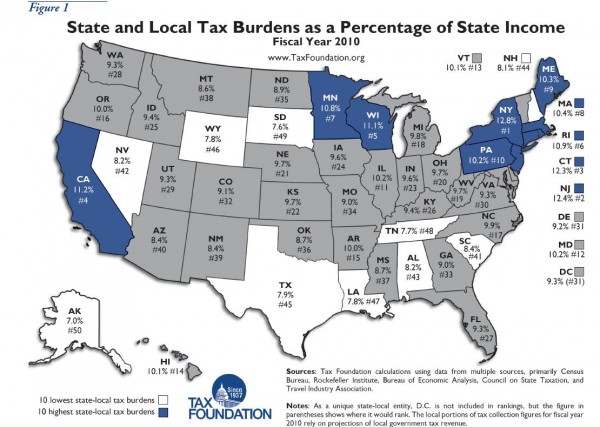

If you look at this map from the Tax Foundation, you’ll notice that there is a heavy overlap between the 10 states with the lowest overall tax burdens and the 9 states (Alaska, Florida, New Hampshire, Nevada, South Dakota, Tennessee, Texas, Washington, Wyoming) that don’t have income taxes.

More specifically, 7 of the non-income tax states are among the 10 states with the lowest tax burdens. Only Florida and Washington are outside the top 10.

It’s also worth noting that some of the states with the most “progressive” income tax systems are well represented on the list of the 10-worst states – including California, New York, New Jersey, Maine, and Rhode Island.

One important implication of this data is that proponents of limited government should never give politicians a new source of revenue, which is why fighting the value-added tax is one of my main priorities (and why advocates of small government should be worried not just about Obama winning re-election, but also worried about Romney winning).