Even though I knew some people would call me Scrooge, I wrote a few days ago about why we should get rid of the tax deduction for charitable contributions in exchange for lower tax rates.

Simply stated, I’m a big advocate of fundamental tax reform, and I would like to scrap the corrupt internal revenue code and replace it with a simple and fair flat tax.

Needless to say, that also means getting rid of tax preferences for housing. I make the case against the home mortgage interest deduction in this interview on the Fox Business Network.

Since a short TV interview doesn’t allow much time for a detailed and wonky analysis of tax policy, this is a good time to explain why tax reform doesn’t really change the tax treatment of housing. But also I’ll explain why it is a big change.

I realize that makes me sound like a politician, talking out of both sides of my mouth, but bear with me.

One of the key principles of tax reform is that there no longer should be any double taxation of income that is saved and invested. As you can see in this chart, people who live for today and immediately consume their after-tax income are basically spared any additional layers of tax. But if you save and invest your after-tax income (which is very good for future growth and necessary to boost workers’ wages), then the government tries to whack you with several additional layers of tax.

The solution is a system that taxes income only one time. And that means all saving and investment should be treated the way we currently treat individual retirement accounts. If you have a traditional IRA (or “front-ended” IRA), you get a deduction for any money you put in a retirement account, but then you pay tax on the money – including any earnings – when the money is withdrawn.

If you have a Roth IRA (or “back-ended” IRA), you pay tax on your income in the year that it is earned, but if you put the money in a retirement account, there is no additional tax on withdrawals or the subsequent earnings.

From an economic perspective, front-ended IRAs and back-ended IRAs generate the same result. Income that is saved and invested is treated the same as income that is immediately consumed. From a present-value perspective, front-ended IRAs and back-ended IRAs produce the same outcome. All that changes is the point at which the government imposes the single layer of tax.

So why am I boring you with all this arcane tax info? Because the home mortgage interest can be considered as a front-ended IRA involving more than one party. The interest paid by the homeowner is deductible, and the interest received by the mortgage company is taxable.

Under a flat tax, the system gets switched to something akin to a back-ended IRA. The homeowner no longer deducts the interest and the recipient of the interest no longer pays tax.

Some of you may be thinking that this is a good deal for financial institutions, but a ripoff for homeowners. But here are two very important points.

- First, homeowners that already have mortgages presumably would be grandfathered, thus allowing them to continue taking the deduction.

They made a contract under the old rules and shouldn’t have the rug pulled out from under them.

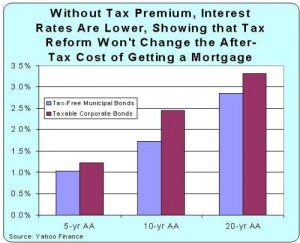

They made a contract under the old rules and shouldn’t have the rug pulled out from under them. - Second, people taking out new mortgages would benefit since mortgage interest would get the same tax treatment now reserved for tax-free municipal bonds. And because there’s no federal income tax on municipal bonds, that means there’s no tax wedge built into the interest rate.

In other words, homeowners or homebuyers in the new system won’t be able to deduct mortgage interest, but they’ll benefit from lower interest rates. Six of one, half dozen of another.

So why, then, is the housing lobby against the flat tax?

In part, they don’t know what they’re talking about. But what about the smart ones, the ones who understand that there’s no meaningful change in the after-tax cost of getting a mortgage in a flat tax world? Why are they opposed to tax reform.

The answer is very simple. They understand that housing isn’t directly affected by a flat tax, but they are very concerned about the indirect impact. More specifically, they understand that the flat tax eliminates all forms of double taxation in the tax code, and that would mean a level playing field.

In other words, the housing sector is now taxed rationally, and other investments are taxed punitively. Under a flat tax, by contrast, all would be taxed rationally. So the housing sector would lose its relative advantage.

So if your industry or sector is the beneficiary of a tilted playing field, then it’s understandable that you’ll be worried about tax reform even if there’s no real change in how you get taxed.

And I suspect the impact of tax reform wouldn’t be trivial.

To get an idea about the potential impact, let’s look at some academic research. Professor Dale Jorgenson of Harvard and another economist from Yonsei University in South Korea estimate that most of the economic benefit of tax reform occurs because capital shifts out of owner-occupied housing and into business investment.

…progressivity of labor income taxation is another major source of inefficiency in the U.S. tax system. This produces marginal tax rates on labor income that are far in excess of average tax rates. A high marginal tax rate results in a large wedge between the wages and salaries paid by employers and those received by households. A proportional tax on labor income would equalize marginal and average tax rates and would sharply curtail the losses in economic efficiency due to high marginal rates. An important challenge for tax reform is to eliminate the barriers to efficient capital allocation arising from ―double‖ taxation of assets held in the corporate sector and the exclusion of owner-occupied housing from the tax base… If both income taxes and sales taxes are replaced by a Flat Tax, and a lump sum tax is used to compensate for the revenue shortfall, the welfare gains are very substantial, $5,111.8 billion U.S. dollars of 2011 for HR and $5,444.3 billion for AS. …Our overall conclusion is that the most substantial gains from tax reform are associated with equalizing tax burdens on all assets and all sectors and eliminating the progressive taxation of labor income… We have shown that the most popular Flat Tax proposals would generate substantial welfare gains.

I don’t pay much attention to the estimates in the study about an extra $5 trillion-plus of wealth. That number is very sensitive to the structure of the model and the underlying assumptions.

But I do agree that tax reform will generate big benefits and that much of the gain will occur because there will be less tax-induced over-investment in housing and more growth-generating investment in business capital.

But as I note in the interview, that’s a good thing. It means more prosperity for the American people and a more competitive American economy.

Government shouldn’t be trying to lure us into making economically irrational decisions because of tax or regulatory interventions. Didn’t we learn anything from the Fannie Mae-Freddie Mac fiasco?

The clowns in Washington have been mucking around in the economy for decades and they keep making things worse. Perhaps, just for a change of pace, we should try free markets and small government and see what happens.