I have a love-hate attitude toward international bureaucracies.

I’m mostly negative about organizations such as the IMF, World Bank, UN, and OECD. In part this is because they are a very expensive burden on taxpayers, but also because they generally push for bad policy.

It’s reprehensible, for instance, that the OECD has allied itself with the Obama Administration to push for class-warfare tax policy. And it’s disgusting that these pampered bureaucrats at the IMF get tax-free salaries while pushing for bailouts and higher taxes.

But I confess that the international bureaucracies sometimes generate good data and produce interesting studies. The World Bank, for instance, showed how the welfare state and excessive government spending are reducing prosperity in Europe. And the European Central Bank also has produced solid research showing that large public sectors undermine economic growth.

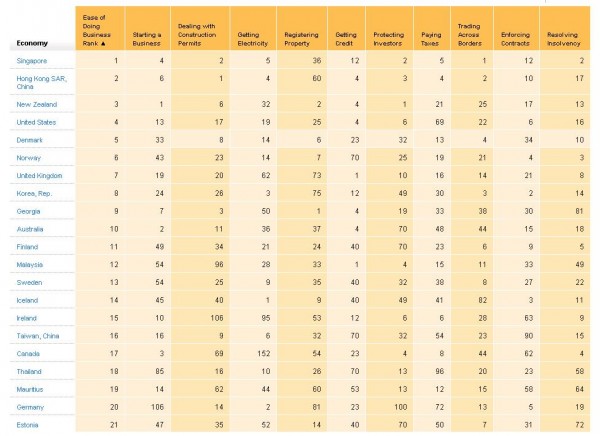

One very good source of data from an international bureaucracy is the Doing Business Index, published each year by the World Bank. As you can see from the image (click to enlarge), the United States does relatively well in this ranking.

Since the United States has dropped in the Economic Freedom of the World Index and the World Economic Forum’s Global Competitiveness Report, it’s nice to see that the news isn’t all bad in the international rankings.

The one area where the U.S. gets a very poor score, though, is in the “paying taxes” category. This is yet another reason why we should junk the corrupt internal revenue code and replace it with a simple and fair flat tax.

Hong Kong and Singapore are at the top of the rankings, unsurprisingly. The Nordic nations also do well, which fits with the analysis showing they are very free market in areas other than fiscal policy. And it’s always good to see Estonia with a relatively high score.