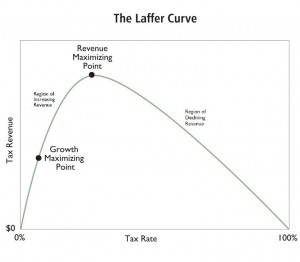

I’ve shared evidence from around the world (England, Italy, the United States, and France) and from various states (Illinois, Oregon, Florida,Maryland, and New York) to argue that it is foolish to ignore the Laffer Curve.

Not that it makes any difference. I’m slowly coming the conclusion that my friends on the left will never learn – in large part because they’re more interested in punishing success with class warfare tax policy than they are in collecting extra revenue for government.

Not that it makes any difference. I’m slowly coming the conclusion that my friends on the left will never learn – in large part because they’re more interested in punishing success with class warfare tax policy than they are in collecting extra revenue for government.

But surely there are some statists who are motivated by emotions other than spite, so I refuse to give up. Let’s look at some evidence from Spain to further confirm that high tax rates aren’t necessarily the way to maximize tax revenue (this also is a story showing that tax competition between nations is a good way of disciplining governments that are too greedy, but that’s another issue).

Here are some details from a CNBC report.

Spain’s corporate tax take has tumbled by almost two thirds from pre-crisis levels as small businesses fail and a growing number of big corporations seek profits abroad to compensate for the prolonged downturn at home. …Spain has a headline corporate tax rate of 30 percent, broadly in line with other large European economies. Switzerland, however, has a headline rate of 8.5 percent, and lawyers say deductions can be made to reduce this further. “A fundamental right of EU law is the freedom of establishment. All companies and taxpayers look after their tax affairs, and if they can pay a lower rate somewhere else, it’s better for their business and natural that they would do so,” a global tax lawyer based in Spain said. …Rajoy did eliminate some corporate tax breaks in 2012, a policy he will continue in 2013, and has also brought forward some tax payments, though that could be storing up problems.

Much of the decline in corporate tax revenue can be attributed to Spain’s dismal economy, of course, which has been exacerbated by a bunch of tax hikes imposed by a supposedly right-of-center government.

The one tax rate that hasn’t been increased, though, is the top rate of corporate tax. So how can this be a story about the Laffer Curve?

Well, sometimes standing still is a recipe for defeat. And sometimes moving in the right direction isn’t enough when everybody else is going in the right direction at a faster rate.

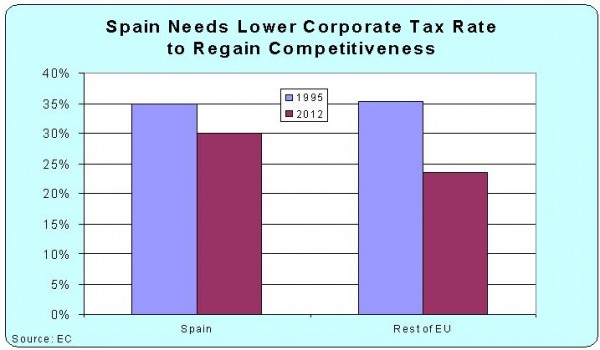

Here’s a chart showing changes in the average EU corporate tax rate compared to Spain’s corporate tax rate.

Spain’s corporate tax rate has dropped by five percentage points. That’s progress, but other nations have moved more rapidly in the right direction. Back in 1995, the Spanish corporate rate was slightly lower than the EU average. Now it’s noticeably higher.

And as the excerpt above notes, there are nations such as Switzerland that have far lower tax rates and much better fiscal policy.

To be sure, Spain’s main challenge is the need to dramatically reduce the burden of government spending. That will help long-run growth because more resources will be allocated by private markets.

But Spain also should seek an immediate boost to growth by reducing tax rates on productive behavior. A lower corporate tax rate should be part of the answer.