Taxes and spending are two of the most obvious burdens imposed by government, and I’m glad that many people are fighting against a political class that seems to have a limitless appetite for a bigger public sector.

But politicians also can do great damage to an economy with mandates, regulations, and other forms of intervention. And because they are indirect and somewhat hidden, these costs are poorly understood by most voters even though the burdens can be enormous.

Interfering with the price system is an especially pernicious form of intervention.

When functioning properly, prices enable the wants and needs of consumers to be properly channeled to producers and suppliers in a way that promotes prosperity and efficiency.

Unfortunately, governments hinder this system with all sorts of misguided policies such as subsidies and price controls.

One of the worst manifestations of this type of intervention is the system of third-party payer, which occurs when government policies artificially reduce the perceived prices of goods and services.

In this post, let’s look at markets for higher education, housing, and health care to get a better understand of how third-party payer leads to rising prices and damaging bubbles.

Let’s start with the market for college education. Glenn Reynolds of Instapundit has been promoting the idea of a higher-education bubble for years. His theory, as he explained in the Washington Examiner, makes a lot of sense.

A couple of years back, I suggested in these pages that higher education was facing a bubble much like the housing bubble: An overpriced good, propped up by cheap government-subsidized credit, luring borrowers and lenders alike into a potentially disastrous mess. …This is a simple case of inflation: When you artificially pump up the supply of something (whether it’s currency or diplomas), the value drops. The reason why a bachelor’s degree on its own no longer conveys intelligence and capability is that the government decided that as many people as possible should have bachelor’s degrees. There’s something of a pattern here. The government decides to try to increase the middle class by subsidizing things that middle class people have: If middle class people go to college and own homes, then surely if more people go to college and own homes, we’ll have more middle class people. But homeownership and college aren’t causes of middle-class status, they’re markers for possessing the kinds of traits — self-discipline, the ability to defer gratification, etc. — that let you enter, and stay in, the middle class. Subsidizing the markers doesn’t produce the traits; if anything, it undermines them. One might as well try to promote basketball skills by distributing expensive sneakers.

I hope he’s right, and I also hope the bubble bursts quickly. The last of my three kids is a senior in high school, so anything that lowers tuition and fees would be most welcome.

But let’s look at some data and think about whether this will happen.

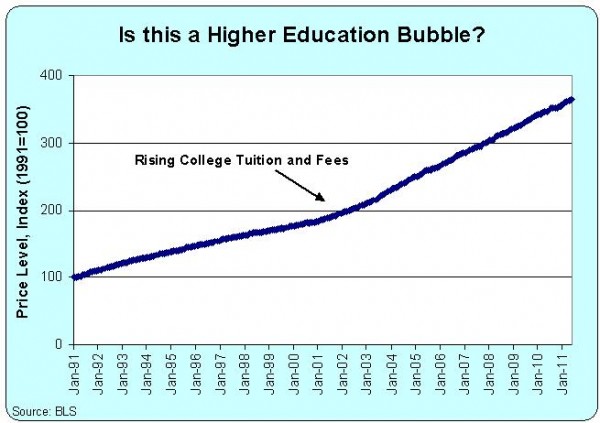

This first chart, using data from the Bureau of Labor Statistics on college tuition and fees, certainly shows a big jump in the cost of higher education. Indeed, tuition and fees have climbed more than twice as fast as the overall consumer price index.

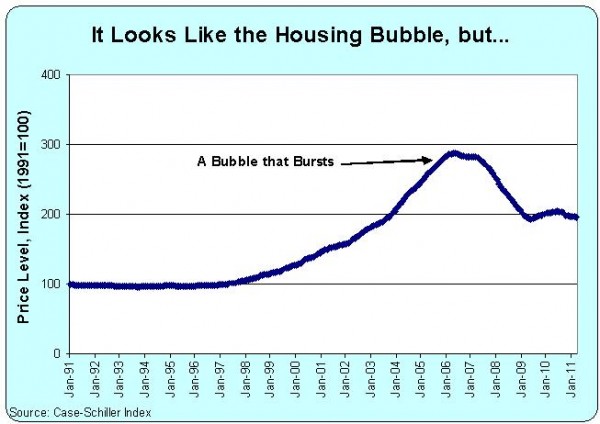

Now let’s look at the Case-Schiller data on housing prices in the second chart. While the lines aren’t identical, it certainly seems like Instapundit is on to something. When the government intervenes in a sector of the economy with lots of subsidies, prices climb rapidly.

The key question, of course, is whether the market for higher education will behave the same way as the market for housing. In other words, has the government created a house of cards that inevitably will collapse?

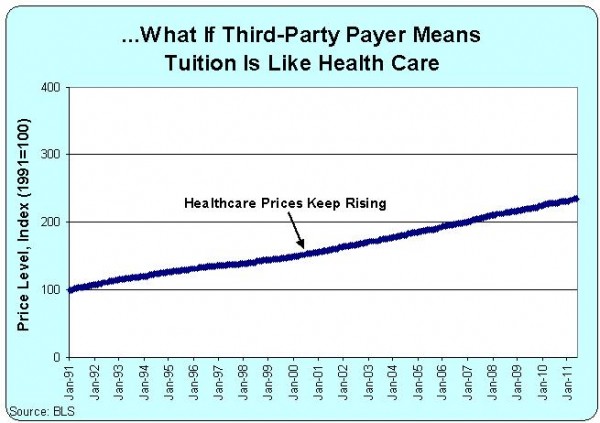

As noted above, I hope there’s a bubble that’s on the verge of bursting. But since I tend to be a pessimist, I’m worried that the education market may be more similar to the healthcare market rather than the housing market. Take a look at this final chart, showing what seems to be endlessly rising prices for medical care.

As noted above, I hope there’s a bubble that’s on the verge of bursting. But since I tend to be a pessimist, I’m worried that the education market may be more similar to the healthcare market rather than the housing market. Take a look at this final chart, showing what seems to be endlessly rising prices for medical care.

So why do I worry that higher education may be more like healthcare? Because both benefit from third-party payer, which happens when someone other than the consumer pays a significant share of the cost of a product. For instance, consumers directly pay for only 12 cents of every dollar of healthcare they consume. So why care about rising prices when somebody else is picking up the tab?

Indeed, in the few areas where out-of-pocket expenditures dominate, such as cosmetic surgery and abortion, we find that prices are stable or even falling.

In the case of higher education, there is substantial third-party payer because of money funneled to students in the form of grants and loans, as well as funds channeled directly to colleges and universities.

There is some third-party payer in the housing market, but the bubble that recently popped was more the result of (hopefully) one-time factors such as the Fed’s easy-money policy and Fannie Mae and Freddie Mac subsidies that caused reckless lending and foolish speculation.

So what does all this mean? The honest answer is that I don’t know, but I fear that there is no looming collapse in the price of higher education. At best, we have probably reached a point where prices have leveled off, but that’s more a function of a glut in certain fields such as law.