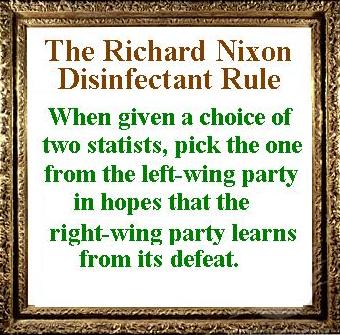

Even though he is a foolish statist, I wanted Francois Hollande to win the French presidency. Sarkozy was a statist as well, after all, and my “Richard Nixon Disinfectant Rule” says that it’s better to have the out-of-the-closet statist prevail in such contests in hopes that the supposedly right-of-center party  can then regroup and offer voters a true choice in the next election.

can then regroup and offer voters a true choice in the next election.

But I have another reason for wanting Monsieur Hollande. Simply stated, we need role models. Not only role models to show the effects of good policy (like Estonia and Hong Kong), but also clear-cut examples of nations that do the wrong thing.

I fully expect France to be that kind of role model over the next few years. Particularly if Hollande follows through on his scheme to push the top tax rate to 75 percent.

I’ve already written about the experiment America conducted in the 1980s, when Reagan lowered the top tax rate from 70 percent to 28 percent. Hollande wants to conduct a similar experiment, but in reverse.

Indeed, we’re already seeing the potential impact of class-warfare tax policy in France. Here are the key passages from a report in the Financial Times.

Wealthy French people are looking to London as a refuge from fresh taxes on high earners pledged by candidates in the country’s presidential elections. The “soak the rich” rhetoric that has punctuated the presidential campaign has prompted a sharp rise in the numbers weighing a move across the Channel, according to London-based wealth managers, lawyers and property agents specialising in French clients. François Hollande, the Socialist candidate…, wants to impose a tax rate of 75 per cent on income above €1m… Inquiries from French clients had risen by roughly 40 per cent since the speech, says David Blanc, a partner at Vestra Wealth, a London-based wealth manager. …The prospect of a Gallic diaspora of high earners was backed up by Knight Frank, the property agent, which said numbers of French web users searching online for its prime London properties online in the past three months had risen 19 per cent compared with the same period last year. The equivalent figure for Europe as a whole fell 9 per cent. …Mr Blanc says some French clients were even contemplating acquiring British or other nationality in order to safeguard assets from fears that France could move to collect more tax from citizens overseas. “A lot of people are extremely worried,” he said. Alexandre Terrasse, a partner in corporate and property law at Jeffrey Green Russell, says he had seen a 25 per cent rise in activity from French clients over the past six months, “The 75 per cent tax is clearly a sign that the politicians will hit the wealthy and they don’t want to have to deal with that.”

In other words, just a productive people “vote with their feet” by escaping from high-tax hell-holes like California to zero-income-tax states such as Texas, the same phenomenon exists for people crossing national borders.

This means Mr. Hollande is going to learn an interesting math lesson: 75 percent of zero is a very small number.

The Laffer Curve lives! And left wingers who pretend it doesn’t exist learn very unhappy lessons.

P.S. Here’s a good joke about Texas and California, and here’s a serious post about the differences between the two states.