Even though I’m not a Romney fan, I sometimes feel compelled to defend him against leftist demagoguery.

But instead of writing about tax havens, as I’ve done in the past, today we’re going to look at incremental tax reform.

The left has been loudly asserting that the middle class would lose under Mitt Romney’s plan to cut tax rates by 20 percent and finance those reductions by closing loopholes.

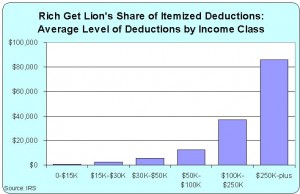

That class-warfare accusation struck me as a bit sketchy because when I looked at the data a couple of years ago, I put together this chart showing that rich people, on average, enjoyed deductions that were seven times as large as the deductions of middle-income taxpayers.

That class-warfare accusation struck me as a bit sketchy because when I looked at the data a couple of years ago, I put together this chart showing that rich people, on average, enjoyed deductions that were seven times as large as the deductions of middle-income taxpayers.

And the chart includes only the big itemized deductions. There are dozens of other special tax preferences, as shown in this depressing image, and you can be sure that rich people are far more likely to have the lawyers, lobbyists, and accountants needed to exploit those provisions.

But that’s not a surprise since the internal revenue code has morphed into a 72,000-page monstrosity (this is why I sometimes try to convince honest leftists that a flat tax is a great way of reducing political corruption).

But this chart doesn’t disprove the leftist talking point, so I’m glad that Martin Feldstein addressed the issue in today’s Wall Street Journal. Here’s some of what he wrote.

The IRS data show that taxpayers with adjusted gross incomes over $100,000 (the top 21% of all taxpayers) made itemized deductions totaling $636 billion in 2009. Those high-income taxpayers paid marginal tax rates of 25% to 35%, with most $200,000-plus earners paying marginal rates of 33% or 35%. And what do we get when we apply a 30% marginal tax rate to the $636 billion in itemized deductions? Extra revenue of $191 billion—more than enough to offset the revenue losses from the individual income tax cuts proposed by Gov. Romney. …Additional revenue could be raised from high-income taxpayers by limiting the use of the “preferences” identified for the Alternative Minimum Tax (such as excess oil depletion allowances) or the broader list of all official individual “tax expenditures” (such as tax credits for energy efficiency improvements in homes), among other credits and exclusions. None of this base-broadening would require taxing capital gains or making other changes that would reduce the incentives for saving and investment. …Since broadening the tax base would produce enough revenue to pay for cutting everyone’s tax rates, it is clear that the proposed Romney cuts wouldn’t require any middle-class tax increase, nor would they produce a net windfall for high-income taxpayers. The Tax Policy Center and others are wrong to claim otherwise.

In other words, even with a very modest assumption about the Laffer Curve, it would be quite possible to implement something akin to what Romney’s proposing and not “lose” tax revenue.

This doesn’t mean, of course, that Romney seriously intends to push for good policy. I’m much more concerned, for instance, that he’ll wander in the wrong direction and propose something very bad such as a value-added tax.

But Romney certainly can do the right thing if he wins. Assuming that’s what he wants to do.

Just like he can fulfill his promise the reduce the burden of government spending by implementing Paul Ryan’s entitlement reforms. But don’t hold your breath waiting for that to happen.