Regular readers know I’m not a fan of the Organization for Economic Cooperation and Development. Heck, just take a look at some of the

examples in this post and you’ll understand why.

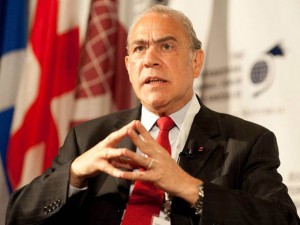

Well, the Secretary-General of the Paris-based bureaucracy just pontificated about the value-added tax. Let’s see whether my knee-jerk hostility is warranted.

Here is the basic hypothesis from the OECD’s head bureaucrat.

Our VAT policies are important tools to foster growth and employment, but also to build stronger, cleaner and fairer economies.

That’s a bold sentence, so let’s dissect it. Starting with the last part, I’m not sure what he means by “cleaner,” so let’s set that aside. I assume “fairer” is a code word for class warfare, though it doesn’t make sense in this context since a VAT – for all its other flaws – is a proportional levy.

So what does he mean by “foster growth and employment” and making an economy “stronger”? Does that mean the OECD is recommending big reductions in VAT rates? That would make sense since the VAT is similar to the income tax in that it drives a wedge between pre-tax income and post-tax consumption.

But you have to remember we’re dealing with the OECD, and on policy matters the Paris-based bureaucracy inevitably supports statism. So you won’t be surprised to learn that the OECD thinks higher VAT rates are good for growth! I’m not joking. Let’s look at what the Secretary-General of the OECD said.

VAT policies are playing a strategic role in our recovery efforts, but they could do more. Many countries are seeking to raise additional revenues from VAT as part of their fiscal consolidation strategies. Between 2009 and 2012, sixteen OECD countries increased their VAT rates. Six more increased their VAT rates. This is reflected in the OECD average standard VAT rate that has risen from 17.7% in 2008 to 19% today. This is quite remarkable considering that the OECD average had remained stable for over ten years before 2008. Raising the standard rate is the easiest way to increase revenue. …Another option for governments is to consider broadening the tax base, such that goods and services that are now exempt or subject to reduced rates would gradually be taxed at the standard rate.

In other words, he’s bragging that the VAT is easy to raise and he’s happy that the average VAT rate has jumped significantly.

But what’s really amazing is that he claims this is pro-growth, part of “our recovery efforts.” So the OECD is just as clueless as the Congressional Budget Office and is embracing the view that higher tax burdens are good for the economy.

This is par for the course for the OECD, as you can see from this video.

Something to keep in mind for lawmakers who are looking for an easy way to save $100 million without taking away any goodies from American voters.