I’m in Jersey, where I gave a speech last night.

But not New Jersey, the state where you shouldn’t die. That’s the state that many people have been fleeing because they don’t like paying confiscatory taxes to finance bureaucrats who make as much as $320,000 per year.

Instead, I’m in the Bailiwick of Jersey, which is a UK dependent territory off the coast of France. Jersey is a so-called tax haven, which I applaud because it helps encourage better tax policy in less enlightened parts of the globe.

Because I’m such a cultured and sophisticated guy, today I used some of my free time to visit the Jersey Museum. I now know lots of useless trivia about how a tiny island 15 miles from France wound up as an English territory.

But I also found something very interesting in the section on the economic history of Jersey. The museum explicitly recognizes the role of low taxation in promoting a prosperous society.

But I also found something very interesting in the section on the economic history of Jersey. The museum explicitly recognizes the role of low taxation in promoting a prosperous society.

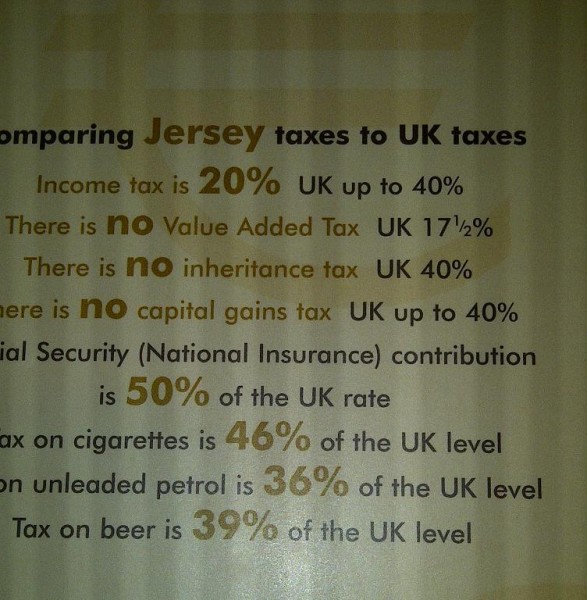

My blackberry camera isn’t that good and I’m probably a crummy photographer, so this image is very hard to read, but the display openly boasts that Jersey’s tax rates are much less onerous than those found in the United Kingdom.

If you want a simple and fair flat tax, Jersey’s 20 percent rate is not bad. And it’s definitely a lot better than the (now) 45 percent top rate in the United Kingdom

If you don’t want double taxation, the capital gains tax rate in Jersey is zero. That’s a lot better than the United Kingdom (though the rate there is now “only” 28 percent.

If you don’t want the government grabbing a big chunk of your income with a value-added tax, then you’re much better off with Jersey’s 5 percent rate rather than the 20 percent rate in the United Kingdom (the museum’s info is out-of-date).

Anyhow, you get the idea. Here’s a close-up photo of that part of the display.

There’s no death tax in Jersey, which is a very important consideration when successful and productive people decide where to conduct economic activity. The United Kingdom, by contrast, has one of the most onerous death tax regimes in the world.

In other words, the people of Jersey have made a very intelligent decision to avoid class-warfare tax policy.

Are you surprised to learn, therefore, that they are richer, on average, than folks in the USA?