I appeared on CNBC yesterday to talk about the “fiscal cliff” and the potential impact on economic performance.

You won’t be surprised to learn that I’m mostly concerned with how the issue gets resolved. Yes, there is some temporary uncertainty that is probably making markets skittish, but I’m much more worried about Obama bullying the GOP into agreeing to a class-warfare deal that leads to higher tax rates on investors, entrepreneurs, and small business owners, as well as more double taxation on saving and investment.

And the long-run damage caused by a more punitive tax system is much more important than any short-run delay in investment expenditures.

I made two points that deserve some elaboration.

First, not all government spending is created equal. As explained in the Rahn Curve video, outlays to provide core public goods are associated with better economic performance. Expenditures for human capital (education) and physical capital (infrastructure) are a mixed bag, depending on whether governments make wise decisions. The bad news, though, is that the vast majority of current government spending is diverted for what is called transfer and consumption spending, and these forms of redistributive outlays are associated with weaker economic performance.

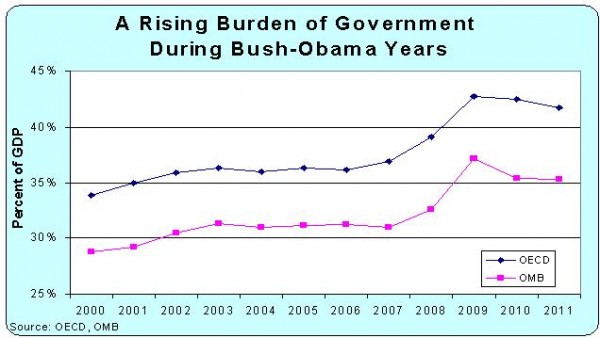

Second, I’m glad I had the opportunity to explain how America’s fiscal status has deteriorated during the Bush-Obama years. One of the CNBC staff understated the magnitude of the problem by looking at just federal spending as a share of GDP and only over the past few years. I pointed out that total government spending is the right variable, and I explained that the trend line has been moving in the wrong direction since Bill Clinton left office.

In this chart, you can see the bad news using either the methodology of the Office of Management and Budget or the approach of the Organization for Economic Cooperation and Development. Since I’m not sure which approach is right, I basically split the difference when discussing the overall burden of government spending.

Keep in mind, by the way, that these numbers are just the tip of the iceberg. Without real entitlement reform, federal spending as a share of GDP will double and total government outlays will rise to at least 60 percent of GDP.

We need some sort of spending cap, ideally akin to the Swiss Debt Brake. But that won’t happen for at least the next four years.

But maybe, with enough pressure, we can convince politicians to comply with my Golden Rule. After 12 years of excessive spending, it’s time to let the private sector grow faster than the government.