A problem in Washington is that people who specialize in particular fields are tempted to exaggerate the importance of their issues. To cite a couple of examples:

- People who work on monetary policy think their issue is most important, and you can understand why after watching this George Selgin video.

- People who work on regulatory policy think their issue is most important, and you can understand why after perusing this report about the record $1.75 trillion yearly burden of red tape.

- People who work on fiscal policy think their issue is most important, and you can understand why after looking at the data about America’s Greek-style fiscal future.

This is an understandable tendency, and I’m sometimes guilty of over-emphasizing fiscal policy. But all of us should realize that a country’s economic performance is governed by a wide range of policies.

Indeed, the research suggests that there are five big factors that determine prosperity, and they’re all equally important.

- Rule of law and property rights

- Sound money

- Fiscal policy

- Trade policy

- Regulatory policy

This video provides a good explanation.

I’m frequently reminded of this video when I debate people who claim that higher taxes are desirable because the economy expanded during the 1990s. But as I’ve explained, Clinton’s 1993 tax increase was anti-growth (and definitely didn’t balance the budget), but its harmful impact was more than offset by pro-growth policies – such as a reduction in the burden of federal spending, trade liberalization, welfare reform, and deregulation.

But that’s not the topic of this post. Instead, I want to discuss the causes of growth, but dig a bit deeper into the relationship between public policy and prosperity. Specifically, let’s consider the importance of entrepreneurship.

Conventional economic theory says that economic output is a function of labor and capital. And if you want an economy to produce more, your only choices are to somehow achieve one or more of the following:

- More capital.

- More labor.

- More efficient use of capital.

- More productive use of labor.

In other words, labor and capital are the two ingredients that determine economic performance. But this conventional theory is incomplete. It usually overlooks the role of entrepreneurship.

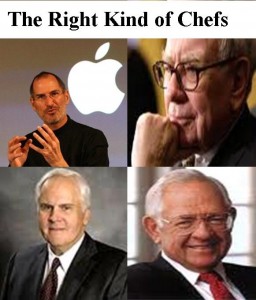

In simple terms, entrepreneurs are the chefs, the people who mix together the two ingredients of labor and capital.

But this then raises an important question. Who are the entrepreneurs? Do we want politicians and bureaucrats in Washington to play that role? Even if we assume they are totally honest and non-corrupt, that seems to be the wrong answer. When politicians try to allocate labor and capital, we get policies like Solyndra. We get Fannie Mae and Freddie Mac. We get TARP, the minimum wage law, and a 72,000-page tax system.

But this then raises an important question. Who are the entrepreneurs? Do we want politicians and bureaucrats in Washington to play that role? Even if we assume they are totally honest and non-corrupt, that seems to be the wrong answer. When politicians try to allocate labor and capital, we get policies like Solyndra. We get Fannie Mae and Freddie Mac. We get TARP, the minimum wage law, and a 72,000-page tax system.

And unlike the private sector, there’s no virtuous feedback. Indeed, failure often results in more resources getting diverted in an effort to compensate for the original failure. Sort of Mitchell’s Law on steroids.

When chefs are from the private sector, by contrast, there is a bottom-line incentive to allocate labor and capital in ways that increase economic output. This doesn’t mean entrepreneurs are always right. Markets are a never-ending learning process.

But when private entrepreneurs hit upon a good recipe, they are rewarded by consumers, which means that both labor and capital get good results – meaning higher wages for workers and profits for investors.

But when private entrepreneurs hit upon a good recipe, they are rewarded by consumers, which means that both labor and capital get good results – meaning higher wages for workers and profits for investors.

In other words, there’s more economic output. In colloquial terms, the pie gets bigger. In a system where markets are allowed to operate, entrepreneurs constantly try to figure out ways of satisfying consumers, and this process of self interest makes us more prosperous.

Let’s now circle back to the role of public policy and think about the five main determinants of economic performance and how they relate to entrepreneurship.

- In a nation with poor rule of law and weak protection of property rights, entrepreneurs are undermined in their efforts to innovate, expand, and create.

- In a nation with bad monetary policy, entrepreneurs are hampered because the basic unit of account and medium of exchange is unstable.

- In a nation with onerous fiscal policy, entrepreneurs are discouraged because government is misallocating resources and imposing punitive tax rates.

- In a nation with protectionist trade policy, entrepreneurs are denied the ability to buy and sell in ways that enable the most productive use of labor and capital.

- In a nation with interventionist regulatory policy, entrepreneurs are saddled with extra costs that make it more expensive to mix labor and capital in ways that most effectively satisfy consumer desires.

One final point. Warren Buffett probably doesn’t belong in the montage of good chefs since he’s now playing footsie with politicians in exchange for special handouts. But I’m using an old image and was too lazy to photoshop someone new to take his place.

So ignore him and focus on the key message, which is that a policy mix of small government and free markets is the best way of unleashing entrepreneurs.