Back in 2010, I posted a fascinating map from the Economist website, showing debt burdens (as a share of GDP) for nations around the world. This data showed lots of red ink, with Western Europe generally being more indebted than the United States.

In 2011, I posted some charts from a study by the Bank for International Settlements, revealing that the long-run fiscal outlook for the United States is worse than the outlook for European nations.

In other words, our politicians to date haven’t over-spent as much as their counterparts in Europe, but it appears that – if government is left on auto-pilot – America will suffer more from excessive government than European nations in the future.

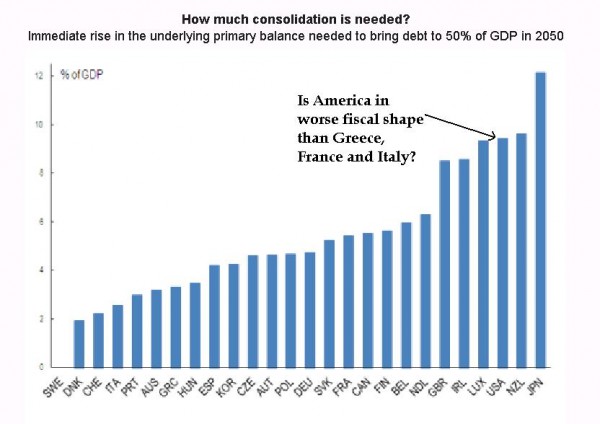

Here’s some new evidence about the perilous long-term state of public finances in America. According to the Organization for Economic Cooperation and Development, the United States has to do more than almost every other nation to avoid becoming another Greece.

If this data is correct, the United States isn’t just in danger of becoming Greece. It’s actually in worse shape than Greece. Not just Greece, but every other European welfare state as well. That doesn’t bode well.

But time for some caveats. The OECD research mistakenly focuses on debt levels and what needs to happen to reduce red ink to a certain level. This isn’t a meaningless issue, but it puts the cart before the horse. What matters most is the size of government and the total burden of government spending – not whether it is financed with borrowing rather than taxes.

This doesn’t mean the long-run estimates are wrong. But if the focus is on the real problem of government spending, then it is much more apparent that the only feasible solution is to restrain the growth of government spending.

If the burden of government spending grows slower than the economy’s productive sector (i.e., Mitchell’s Golden Rule), then deficits and debt fall. To be blunt, if you cure the disease, the symptoms automatically disappear.

Which helps explain why I’m a fan of the Ryan budget, particularly his reforms to Medicare and Medicaid.

P.S. Regular readers know I’m not a fan of the OECD (for many reasons), but the economists at the Paris-based bureaucracy generally are competent at putting together good data. It goes without saying, of course, that this doesn’t justify raping taxpayers to subsidize economists.