President Obama and other statists in Washington want a big class-warfare tax hike. They claim the additional revenue is necessary to reduce red ink.

But their ideological crusade is based on some blatant distortions.

- They tell us that tax increases are necessary, but even CBO data shows that the budget can be balanced in just 10 years if politicians merely limit federal spending so that it grows by “only” 2.5 percent per year.

- They tell us the “rich” should pay more, but we know upper-income taxpayer have considerable ability to alter the timing, level, and composition of their income, so we can expect significant Laffer Curve effects.

- They tell us that the money will be used to reduce the deficit, but at the same time they want to cancel the sequester, thus eliminating the only source of spending restraint from the 2011 debt-limit agreement.

In other words, the Obama tax hike will make government bigger, even if some naively support the tax hike because they want smaller deficits.

That being said, I’m not overly optimistic that Obama’s divisive proposal can be stopped, largely because I don’t think Republicans will take my advice on how to win this fight.

But at least the American people have an appropriately jaundiced view about what will happen if Obama does prevail.

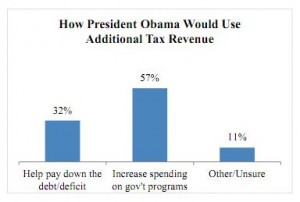

Here are the results of a recent poll showing that a strong majority understand that more revenue will lead to an expansion in the burden of government spending.

Here are the results of a recent poll showing that a strong majority understand that more revenue will lead to an expansion in the burden of government spending.

Though I suppose these numbers don’t necessarily show that people are against higher taxes. Perhaps some of the 57 percent want higher taxes because they want more government.

After all, that’s the most logical interpretation of the election results in California, where voters approved a referendum to rape and pillage upper-income taxpayers.

But I suspect – and definitely hope – that most of the 57 percent understand that making America more like Europe is not a desirable outcome.

By the way, I shared some polling data last week showing that CPAs think that changes in tax rates lead to substantial Laffer Curve effects.

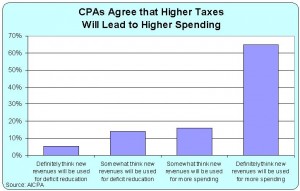

They were also asked their opinion on whether higher taxes will be used for deficit reduction.

They were also asked their opinion on whether higher taxes will be used for deficit reduction.

As you can see, they were even more skeptical than the general public, with more than 60 percent definitely thinking that more revenue in Washington will lead to more spending.

To be sure, there’s no particular reason to think that CPAs have any special insight on this issue. On the Laffer Curve question, by contrast, they presumably do have insider knowledge of how taxpayers respond when tax policy changes.

But I’m digressing. The point of this post is to explain that higher taxes will lead to bigger government.

And if you don’t believe me, then why did the New York Times unintentionally admit that the only budget deal that actually resulted in a budget surplus was the one that cut taxes instead of raising them?