Early last year, CF&P released this video, narrated by yours truly, making the case that the United States and other nations should shift from a tax-and-transfer entitlement scheme to a system of personal retirement accounts.

Some left wingers criticized the idea, saying the big drop in the stock market in 2008-2009 is proof that personal retirement accounts are too risky.

You won’t be surprised to learn, though, that they are wrong. It is true that retirement income fluctuates with a system of personal accounts, but that simply means that it is difficult to predict how much more income one would enjoy when compared to being stuck with Social Security.

Here is the key section from a just-released paper authored by my Cato colleague, Mike Tanner.

Despite recent declines in the stock market, a worker who had invested privately over the past 40 years would have still earned an average yearly return of 6.85 percent investing in the S&P 500, 3.46 percent from corporate bonds, and 2.44 percent from government bonds. If workers who retired in 2011 had been allowed to invest the employee half of the Social Security payroll tax over their working lifetime, they would retire with more income than if they relied on Social Security. Indeed, even in the worst-case scenario—a low-wage worker who invested entirely in bonds—the benefits from private investment would equal those from traditional Social Security.

Some people doubtlessly will still be skeptical of personal accounts, thinking to themselves that a check from the government might be meager, but at least it’s guaranteed.

But that is a very foolish assumption. When the welfare state begins to collapse and it becomes apparent that higher taxes simply make a bad situation even worse, politicians will have no choice but to renege on unaffordable promises. Just look at what’s happening in Greece and elsewhere in Europe.

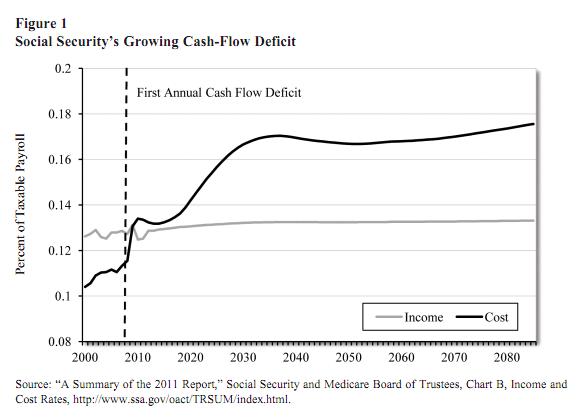

And as this chart from Mike’s paper illustrates, American politicians have dug a huge hole. Relying on the empty promises of Washington politicians will be far more risky than personal retirement accounts.

The chart shows big funding shortfalls, particularly once the baby boomers have retired. Most people, though, aren’t familiar with concepts such as “percent of taxable payroll.”

So let’s make it simple. If we look at all of the future deficits, adjust them for inflation so we can make an apples-to-apples comparison, and then add them up, the Social Security shortfall is close to $30 trillion.

We know that personal accounts work. Nations such as Australia, Chile, and Sweden have reaped big benefits by making the shift.

I’m not surprised that left-wing journalists want to trap American workers in a bad system. But I am disappointed that a lot of Republican politicians feel the same way.