President Obama supports higher taxes, but he usually claims he only wants higher tax rates on evil rich people as part of his class-warfare agenda. Heck, he promised back in 2008 that, “no family making less than $250,000 a year will see any form of tax increase. Not your income tax, not your payroll tax, not your capital gains taxes, not any of your taxes.”

I guess we’re supposed to forget the higher tax burdens that were imposed on the middle class by Obamacare in 2010 and the SCHIP legislation in 2009.

Obama’s other rhetorical trick is to claim he wants a “balanced approach.” Translated from Washington-speak to English, that means he wants more of our money. But it’s a soothing way to demand more money. After all, who’s against “balance”?

I actually agree with Obama – but only if one uses honest math. Needless to say, Obama wants to use Washington math, where spending increases get redefined as spending cuts if the burden of government spending doesn’t rise as fast as was projected in some artificial baseline.

This is why the budget deals put together by politicians almost always are awful. In order to protect the goodies they hand out to various special interests, the politicians use fake numbers to pretend they’re restraining spending, but when the dust settles, it turns out that the only real result is that taxpayers are forking over more of their hard-earned cash to the clowns in Washington.

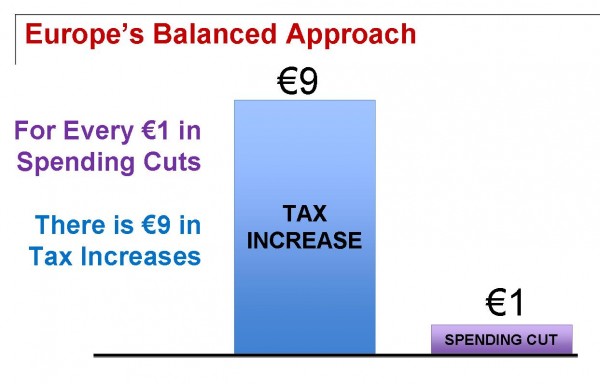

Actually, that statement is incomplete. We need to remember that taxpayers in other nations also get screwed by the political elite. Take a look at this stunning chart that was shown at yesterday’s Cato Institute conference on “Europe’s Crisis and the Welfare State.” Put together by Veronique de Rugy of the Mercatus Center, it shows that politicians across the Atlantic have imposed nine euro of higher taxes for every one euro of spending cuts.

And keep in mind, as Veronique noted in her comments, that many of these so-called spending cuts were merely reductions in planned increases!

This matters because I’m getting increasingly worried that gullible Republicans will get seduced into some sort of budget summit designed to trick them into supporting the Simpson-Bowles tax-hike package.

As I’ve previously explained, this would be a terrible idea. It means a big tax hike with, particularly an increase in the double taxation of income that is saved and invested. It also relies on gimmicks rather than real entitlement reform.

I don’t like higher taxes, but I wouldn’t be completely upset if at least we got some permanent reforms to control the growth of government. But that’s definitely not the case with Simpson-Bowles. And, as Veronique showed, it’s not the case in Europe either.