Even though I have remarked on many occasions that the burden of government was reduced during the Clinton years, that doesn’t mean Bill Clinton was in favor of smaller government. And it definitely doesn’t mean that his appointees believed in economic liberty.

Consider the case of Laura Tyson, who served as Chair of Clinton’s Council of Economic Advisers. She recently penned a column for the UK-based Financial Times that is riddled with disingenuous assertions.

Even though it deserves to be ignored, I can’t resist the temptation to make corrections.

Tyson myth:

“Even after the economy recovers, current tax policies will not generate enough revenue to cover future spending on social security, health, defence and debt interest, let alone basic government operations and investments. In 2012, federal tax revenues are likely to be less than 16 per cent of gross domestic product, compared with an average of more than 18 per cent in the 20 years before the crisis hit in 2008.”

Factual correction:

I already corrected this myth earlier this year when I debunked some disingenuous comments by Obama’s former CEA Chairman.

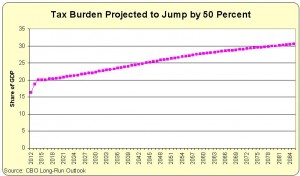

Just take a look at this chart, which assumes that all the 2001 and 2003 tax cuts expire and that millions of additional taxpayers will get nailed by the alternative minimum tax.

Just take a look at this chart, which assumes that all the 2001 and 2003 tax cuts expire and that millions of additional taxpayers will get nailed by the alternative minimum tax.

But even if you assumed that the tax cuts were made permanent and the AMT was constrained, federal tax revenues would jump to above 25 percent of GDP.

As you can see, tax revenues are projected to climb well above the long-run average of 18 percent of GDP. In other words, a rising burden of government spending is responsible for more than 100 percent of America’s long-run fiscal challenge.

Tyson myth:

…there is scant evidence that taxes as a share of GDP and economic growth are negatively correlated. Indeed, there is a small positive correlation between income per capita and tax revenue as a share of GDP.

Factual correction:

Ms. Tyson is trying to take advantage of the paradox of Wagner’s Law, which is that wealthy nations tend to adopt welfare states. And even though the welfare state slows growth, these nations are still richer than some developing countries that have smaller burdens of government.

These posts about Sweden and Denmark show why she’s wrong, but I would also call your attention to this World Bank research that unambiguously shows – using apples-to-apples comparisons – that larger governments reduce prosperity.

Tyson myth:

…tax reform should not come at the expense of progressivity. Income inequality is greater in the US than in the other developed countries of the OECD. The US tax system is considerably less progressive than it was a few decades ago and it does less to counteract pre-tax income inequality than other OECD systems.

Factual correction:

As explained by Veronique de Rugy, America’s tax system actually is more progressive than European tax systems.

But not because we tax rich people more. Instead, our system is more progressive because we don’t screw over lower-income and middle-income taxpayers with policies like the value-added tax.

That’s one of the reasons why the burden of government isn’t as high in the United States – which is very much one of the reasons why there’s so much more prosperity, as shown in this chart, in America than on the other side of the Atlantic.

Tyson myth:

A more efficient and progressive way to pay for a lower corporate tax rate would be to increase taxes on dividends and capital gains. This would shift more of the burden towards capital owners and away from labour, which bears the burden in the form of fewer jobs and lower wages. Mr Obama proposes to raise rates on capital gains and dividends for the top 2 per cent of taxpayers. Most capital gains and dividends go to this group.

Factual correction:

This actually isn’t a myth. She’s simply making an assertion that it would be desirable to increase the double taxation of dividends and capital gains.

America already has pervasive double taxation, as illustrated by this flowchart, and this post shows that Obama’s policies would make a bad situation even worse.

Does anybody think American competitiveness will improve if we have the highest capital gains tax in the industrialized world?

Tyson myth:

The US economy needs efficient and progressive tax reform and it needs more revenues for deficit reduction. Revenue increases have been a significant component of all major deficit-reduction packages enacted over the past 30 years.

Factual correction:

This is remarkable. I assume Ms. Tyson reads the New York Times, so perhaps she overlooked or deliberate forgot the column that inadvertently revealed that the only successful deficit-reduction package in recent memory was the one that cut taxes instead of raising them.

Interestingly, that successful package was implemented during the Clinton years, but only after she left office.

During Tyson’s tenure at CEA, we did get a tax increase rather than a tax cut. But the Clinton Administration admitted 18 months later that the tax hike was a failure and was not going to balance the budget.

Yet she wants to push the same failed class-warfare tax policy today.