The Chairman of the House Budget Committee has produced a new budget plan which contrasts very favorably with the tax-heavy, big-spending proposal submitted by the President last month.

Perhaps most important, Congressman Ryan’s plan restrains spending growth, allowing the private sector to grow faster than the burden of government, thus satisfying Mitchell’s Golden Rule so that spending falls as a share of GDP.

Perhaps most important, Congressman Ryan’s plan restrains spending growth, allowing the private sector to grow faster than the burden of government, thus satisfying Mitchell’s Golden Rule so that spending falls as a share of GDP.

The most important detail in the proposal is that the federal budget, which currently consumes 24 percent of GDP, would fall to less than 20 percent of GDP beginning in 2016.

That’s the good news. There are three pieces of not-so-good news.

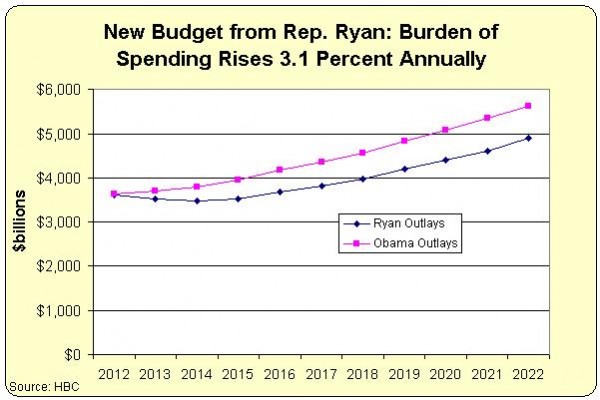

1. Ryan’s plan allows spending to grow by an average of 3.1 percent annually over the next 10 years, with is faster than the 2.8 percent average annual growth in last year’s budget.

2. His proposed Medicare reform, while far better than current law, also is not as good as what was proposed last year.

3. The federal budget would still consume a greater share of the economy’s output than it did when Bill Clinton left office.

I suppose it’s also worth mentioning that Ryan’s proposal isn’t as good as Rand Paul’s budget. Spending only climbs 2.2 percent yearly under the plan put together by the Kentucky Senator, and he also abolishes several useless cabinet-level departments.

But the very good shouldn’t be the enemy of the good. As noted already, Congressman Ryan’s plan meets the most important test, which is restraining spending so that the federal budget grows slower than the private economy. And, as the chart shows, he obviously imposes more fiscal restrain then President Obama.

Regular readers know that I generally show no mercy to jelly-spined Republicans, but I praised GOPers for approving last year’s Ryan budget. The same will be true if they approve this year’s version.

Regular readers know that I generally show no mercy to jelly-spined Republicans, but I praised GOPers for approving last year’s Ryan budget. The same will be true if they approve this year’s version.

P.S. I am frustrated and nauseated by all the people who are fixating on whether Congressman Ryan’s plan balances the budget in 10 years, 20 years, or whenever. What matters is shrinking the burden of government. I hereby bestow the Bob Dole Award on all the people who are mistakenly focusing on the symptom of red ink rather than the underlying disease of bloated government.

P.P.S. I’m happy to report that there is no value-added tax in the revenue portion of Congressman Ryan’s budget. There is a VAT in his Roadmap plan, and I endlessly worry that this poison pill will re-emerge and ruin other good fiscal plans put forth by the Wisconsin lawmaker.