I greatly admire Switzerland’s “debt brake” because it’s really a spending cap.

Politicians are not allowed to increase spending faster than average revenue growth over a multi-year period, which basically means spending can only grow at the rate of inflation plus population.

Theoretically, taxes could be hiked to allow more spending, but that hasn’t happened. The Swiss are very good about voting against tax increases, so the politicians don’t have much ability to boost the revenue trendline.

Since the debt brake first took effect in 2003, the burden of government spending has dropped from 36 percent of GDP to 34 percent of economic output – a rather remarkable achievement since most other European nations have moved in the wrong direction.

Since the debt brake first took effect in 2003, the burden of government spending has dropped from 36 percent of GDP to 34 percent of economic output – a rather remarkable achievement since most other European nations have moved in the wrong direction.

As part of my self-serving efforts to promote Mitchell’s Golden Rule, I’ve been advocating for spending caps in the United States, and I’ve favorably cited legislation proposed by Congressman Brady of Texas and Senator Corker of Tennessee.

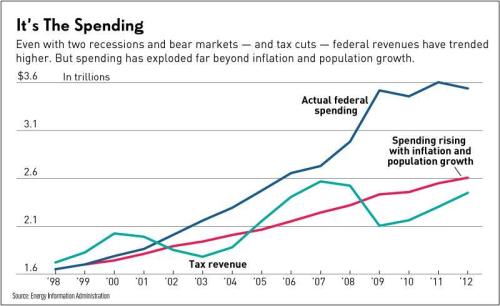

Now I have some new evidence on my side. David Hogberg of Investor’s Business Daily looks at the current fiscal mess in America and discovers – gee, what a surprise – that spending has grown very rapidly since the late 1990s.

President Obama says he wants a “balanced” approach to the fiscal cliff. But critics argue the real problem is spending, which has far outstripped rising tax revenue as well as economic growth. Federal government revenue rose from $1.7 trillion to $2.4 trillion from fiscal 1998 to 2012, slightly exceeding inflation. Revenue growth averaged 2.9% annually, despite two recessions, bear markets — and tax cuts. But federal spending rose nearly twice as fast — 5.7% per year — surging from $1.6 trillion to $3.5 trillion over that same span. The spending spike also exceeds growth in the population.

What’s the solution to this mess? I make the argument for a spending cap.

Dan Mitchell, senior fellow at the libertarian Cato Institute, says the U.S. government needs a spending cap. “It’s an issue of trendlines and that’s everything in fiscal policy,” Mitchell said. “If you are on a path where government spending grows faster than the private sector of the economy, which is your tax base, then in theory there is no level of taxation that will be enough to stabilize the system. … If we had kept government spending down to just increases for inflation and population growth, we wouldn’t be in the trouble we’re in now.” Limiting spending to increases in inflation and population growth over 1998-2012 (an annual average of about 3.3%) would have given dramatically different results. The U.S. would have spent $2.6 trillion in FY 12, about $900 billion less than what it actually did. The latest deficit would be $157 billion, a fraction of the actual $1.089 trillion.

I’ve crunched the numbers to show that we could balance the budget in just 10 years if we just limited spending so that it grew by “only” 2.5 percent annually.

David did the same thing, but looking backwards instead of forward. Here’s the chart included with his article. As you can see, the budget mess would be very manageable today if the Bush-Obama spending binge hadn’t occurred.

But politicians don’t like spending caps for the same reasons that burglars don’t like armed homeowners. As Veronique de Rugy notes, if we imposed a spending cap, they would be forced to reform entitlements.

While a spending cap would help, some analysts contend that it would need to be coupled with entitlement reform. “If you don’t reform Social Security, Medicare and Medicaid, you’ll have a hard time staying within the cap,” said Veronique de Rugy, senior research fellow at the libertarian Mercatus Center. …”To make it feasible and enforceable you’d have to do a constitutional amendment,” said Mitchell. “But even short of that, at least if you start talking about it and set it as your goal it would get people focusing on the real problem … which is government spending growing faster than the private sector.”

This brings us to the real challenge. How do we get politicians to impose reforms when they benefit from the current system. Barring a miracle, they’re not going to tie their own hands.

But I think our chances of success will be much higher if advocates of good fiscal policy kept reminding the crowd in Washington that the real problem is too much spending and that red ink is just a symptom of the underlying disease.