Demonstrating that he’s probably not a fan of Mitchell’s Golden Rule, Paul Krugman recently asserted that fiscal austerity has failed in the United Kingdom.

Citing Keynesian theory and weak economics numbers, he warned about “the austerity doctrine that has dominated elite policy discussion” and says that the British government made a mistake when it decided to “slash spending.”

In support of the New York Times columnist, another blogger commented on the “sharp retrenchment in public spending” in the U.K. And a Bloomberg editorial also supported Krugman’s position, stating that recent events “undermine the conservative idea that slashing government spending will somehow bring about a confidence-driven economic boom.”

There’s only one small, itsy-bitsy, teeny-weeny problem with all of these statements. They’re based on a falsehood. Government spending in the United Kingdom has not been slashed. It hasn’t been retrenched. It hasn’t even been cut.

I first made this point back in 2010. And I also noted that year that the supposedly conservative Chancellor of the Exchequer advocated a big increase in the value-added tax was good since it would generate “13 billion pounds we don’t have to find from extra spending cuts.”

I then repeated myself last year, pointing out once again that government spending was expanding rather than shrinking.

To be fair, spending hasn’t been growing as fast in the past couple of years as it did last decade. According to European Union data, government spending in the United Kingdom grew by an average of 7.6 percent each year between 2000-2008, so the recent annual increases of 2 percent-4 percent may seem frugal by comparison.

But at the risk of stating the obvious, slower spending increases are not budget cuts. Unless, of course, proponents of big government decide to use the dishonest political definition that spending is cut when the budget doesn’t increase as fast as previously planned. But if that’s the case, then they are turning Keynesian economics into a political gimmick.

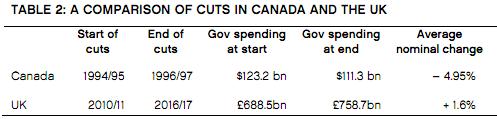

Not only haven’t there been any spending cuts in recent years, but it also appears that there won’t be any in future years. The Centre for Policy Studies just put out a report comparing “austerity” in the United Kingdom today with the fiscal discipline that took place in Canada during the 1990s.

As seen in the table, and as I noted in a previous post, Canada actually reduced spending.

In the United Kingdom, by contrast, spending has been climbing. And that’s projected to happen even in future years.

To be sure, spending in the U.K. won’t grow very fast (assuming the government sticks to its plans, which may be an unrealistic assumption).

But spending that grows slowly is not austerity or retrenchment.

Which is unfortunate, because that’s precisely what is needed in the United Kingdom. And the Canadian experience shows how genuine fiscal restraint generates big benefits.

Let’s also look at some more information from the CPS report.

The Canada of 1994 in many ways resembled the Greece of today. …Spending was to fall 8.8% over two years. Large cuts in transportation, industry, regional development, and scientific support were made. The size of the federal government was to decline from 16.2% of GDP in 1994 to 13.1% in 1996. Public-sector employment was to fall by 14%. The new discipline paid off quickly. Federal government spending as a share of the economy fell more rapidly than planned. Provincial government spending also decreased significantly from 25% of GDP to 20%. …Ottawa offered a historic deal to the provincial governments: unprecedented freedom to make their own welfare policies. This was localism in action – and it unleashed a wave of fruitful experimentation and innovation in the provinces, while spending was cut at the national level. The results were stunning. Large numbers of Canadians, previously trapped in poorly designed benefit programmes, returned to the workforce. By 2000, the number of welfare beneficiaries in Canada had declined by more than a million people, from 10.7% in 1994 of the population to 5.1% in 2009. …Cuts ranged from 5% to 65% of departmental budgets and included cuts to health budgets. In the end, programme spending (everything except interest payments on the debt) fell by 9.7% in nominal terms (or C$11.9 billion) between 1994-95 and 1996-97.

So what were the results of this fiscal discipline? Let’s go back to the report.

Fast-forward again to 2007, and Canada seemed to be back on track. The country’s economy grew at an average rate of 3.3% between 1997 and 2007, the highest average growth among the G-7 countries, including the US. Canada’s job-creation record was nothing short of stellar. From 1997 to 2007, Canada’s average employment growth was 2.1%, doubling that of the US and exceeding employment growth in all other G-7 countries. Perhaps most importantly for future economic prosperity, during the same period Canada outperformed the G-7 average almost every year on business investment. …Canada weathered the recent recession better than its G-7 partners. … None of Canada’s major financial institutions had to be bailed out

And this also was a period of tax cuts.

…coupled with stronger economic performance than expected, meant Ottawa could then cut taxes, including personal and corporate income taxes, capital gains taxes, and the corporate capital tax. In this period:

- Corporate Income Tax (federal) was reduced from 28% to 21% with further cuts planned;

- Capital Gains Tax were reduced to 14.5%;

- Personal Income Tax rates were finally indexed to inflation;

- Federal capital taxes were abolished.

It certainly seems that genuine fiscal restraint worked in Canada.

To be fair, though, Krugman isn’t arguing against small government in his column. He’s arguing for short-run Keynesian stimulus policy. And it’s possible to be in favor of more spending in the short run and smaller government in the long run.

Moreover, I’m not arguing that genuine spending cuts are immediately expansionary, as some research has indicated. I’m sure that happens in some cases, but it’s not a hard and fast rule.

And I imagine that there are cases where the economy does hit a short-run speed bump when the public sector is pruned. Simply stated, there will be transitional costs when the burden of public spending is reduced. Only in economics textbooks is it possible to seamlessly and immediately reallocate resources.

My argument is that the short-term impact of spending restraint – whether positive or negative – is trivial compared to the long-run benefits of better fiscal policy. A small public sector means labor and capital get used more productively, and it presumably also allows a less punitive tax system.

This video has more information about Canada’s fiscal policy success, along with data about similar episodes of genuine austerity (properly defined) in Ireland, Slovakia, and New Zealand.

Even the United States has enjoyed periods of semi-impressive fiscal discipline, most notably during the Reagan and Clinton years. Unfortunately, the modest progress achieved during those periods has been wiped out by the profligacy of the Bush-Obama years.