I sometimes make fun of the English, for reasons ranging from asinine laws to milquetoast politicians to horrid healthcare policy.

But at least some U.K. elected officials are willing to stand up for tax competition and fiscal sovereignty by defending low-tax jurisdictions. In previous posts, I’ve applauded Dan Hannan and Godfrey Bloom for great speeches at the European Parliament.

There are also some sensible people in the U.K. Parliament, most notably Mark Field.

Here are some excerpts from an article in the U.K.-based Telegraph.

A conservative MP has spoken out in defence of tax havens and against what he called “a one-sided debate that demonstrates a fundamental lack of understanding of their role in the global financial market”. …In an attempt to balance the “one-sided” debate on international finance centres (IFCs), Mr Field…advised the UK government to think twice before imposing more regulation on these jurisdictions. …In a bid to dismiss the age-old belief that tax havens attract investors purely because of their tax regimes, Mr Field argued that it is a combination of their political stability, familiar legal systems, quality of service, lack of foreign exchange controls, and tax and legal neutrality that make them ideal locations to deposit money.The current financial crisis, he continued, had more to do with poor regulation and mistakes made onshore rather than offshore, and if the EU pressed ahead with its intention to harmonise tax systems across international borders “it could potentially represent the end for healthy tax competition… Tax harmonisation and cooperation, added Mr Field, was simply Brussels-speak for exporting high tax models on continental Europe to low tax jurisdictions.

These issues are just as relevant for the United States, but how many American politicians stand up and defend free markets and jurisdictional competition as a means of restraining the political predators in Washington?

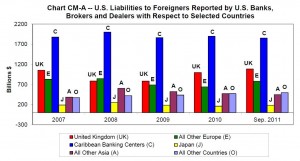

I’m re-posting my video on The Economic Case for Tax Havens below, for those who haven’t seen it. But I also want to call your attention to this chart from the Treasury Department.

You’ll have to click and enlarge it. You’ll see that it shows the amount of capital invested in America from various parts of the world. The “C” category shows that more money is invested in America via Caribbean banking centers such as the Cayman Islands than from any other source.

And this is just one type of foreign investment. As I’ve explained elsewhere, foreigners have more than $10 trillion invested in the U.S. economy, in part because the United States is a tax haven for foreign investors.

So when Obama climbs into bed with the Europeans to push a global network of tax police, he’s pushing policies that ultimately will do great damage to American competitiveness.

Let’s close by returning to the original theme of wise and astute Englishmen. If you want a good defense of tax competition and tax havens, read what Allister Heath wrote last year.