In previous posts, I put together tutorials on the Laffer Curve, tax competition, and the economics of government spending.

Today, we’re going to look at the issue of tax reform. The focus will be the flat tax, but this analysis applies equally to national sales tax systems such as the Fair Tax.

There are three equally important features of tax reform.

- A low tax rate – This is the best-known feature of tax reform. A low tax rate is designed to minimize the penalty of work, entrepreneurship, and productive behavior.

- No double taxation of saving and investment – All major tax reform plans, such as the flat tax and national sales tax, get rid of the tax bias against income that is saved and invested. The capital gains tax, double tax on dividends, and death tax are all abolished. Shifting to a system that taxes economic activity only one time will boost capital formation, thus facilitating an increase in productivity and wages.

- No distorting loopholes – With the exception of a family-based allowance designed to protect lower-income people, the main tax reform plans get rid of all deductions, exemptions, shelters, preference, exclusions, and credits. By creating a neutral tax system, this ensures that decisions are made on the basis of economic fundamentals, not tax distortions.

All three features are equally important, sort of akin to the legs of a stool. Using the flat tax as a model, this video provides additional details.

One thing I don’t mention in the video is that a flat tax is “territorial,” meaning that only income earned in the United States is taxed. This common-sense rule is the good-fences-make-good-neighbors approach. If income is earned by an American in, say, Canada, then the Canadian government gets to decide how it’s taxed. And if income is earned by a Canadian in America, then the U.S. government gets a slice.

It’s also worth emphasizing that the flat tax protects low-income Americans from the IRS. All flat tax plans include a fairly generous “zero-bracket amount,” which means that a family of four can earn (depending on the specific proposal) about $25,000-$35,000 before the flat tax takes effect.

Proponents of tax reform explain that there are many reasons to junk the internal revenue code and adopt something like a flat tax.

- Improve growth – The low marginal tax rate, the absence of double taxation, and the elimination of distortions combine to create a system that minimizes the penalties on productive behavior.

- Boost competitiveness – In a competitive global economy, it is easy for jobs and investment to cross national borders. The right kind of tax reform can make America a magnet for money from all over the world.

- Reduce corruption – Tax preferences and penalties are bad for growth, but they are also one of the main sources of political corruption in Washington. Tax reform takes away the dumpster, which means fewer rats and cockroaches.

- Promote simplicity –

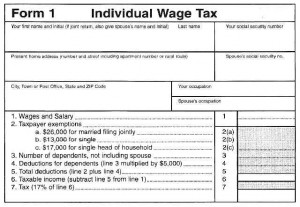

Good policy has a very nice side effect in that the tax system becomes incredibly simple. Instead of the hundreds of forms required by the current system, both households and businesses would need only a single postcard-sized form.

Good policy has a very nice side effect in that the tax system becomes incredibly simple. Instead of the hundreds of forms required by the current system, both households and businesses would need only a single postcard-sized form. - Increase privacy – By getting rid of double taxation and taxing saving, investment, and profit at the business level, there no longer is any need for people to tell the government what assets they own and how much they’re worth.

- Protect civil liberties – A simple and fair tax system eliminates almost all sources of conflict between taxpayers and the IRS.

All of these benefits also accrue if the internal revenue code is abolished and replaced with some form of national sales tax. That’s because the flat tax and sales tax are basically different sides of the same coin. Under a flat tax, income is taxed one time at one low rate when it is earned. Under a sales tax, income is taxed one time at one low rate when it is spent.

Neither system has double taxation. Neither system has corrupt loopholes. And neither system requires the nightmarish internal revenue service that exists to enforce the current system.

This video has additional details – including the one caveat that a national sales tax shouldn’t be enacted unless the 16th Amendment is repealed so there’s no threat that politicians could impose both an income tax and sales tax.

Last but not least, let’s deal with the silly accusation that the flat tax is a risky and untested idea. This video is a bit dated (some new nations are in the flat tax club and a few have dropped out), but is shows that there are more than two dozen jurisdictions with this simple and fair tax system.

P.S. Fundamental tax reform is also the best way to improve the healthcare system. Under current law, compensation in the form of fringe benefits such as health insurance is tax free. Not only is it deductible to employers and non-taxable to employees, it also isn’t hit by the payroll tax. This creates a huge incentive for gold-plated health insurance policies that cover routine costs and have very low deductibles. This is a principal cause (along with failed entitlement programs such as Medicare and Medicaid) of the third-party payer crisis. Shifting to a flat tax means that all forms of employee compensation are taxed at the same low rate, a reform that presumably over time will encourage both employers and employees to migrate away from the inefficient over-use of insurance that characterizes the current system. For all intents and purposes, the health insurance market presumably would begin to resemble the vastly more efficient and consumer-friendly auto insurance and homeowner’s insurance markets.

P.P.S. If you want short and sweet descriptions of the major tax reform plans, here are four highly condensed descriptions of the flat tax, national sales tax, value-added tax, and current system.