Being a thoughtful and kind person, I offered some advice last year to Barack Obama. I cited some powerful IRS data from the 1980s to demonstrate that there is not a simplistic linear relationship between tax rates and tax revenue.

In other words, just as a restaurant owner knows that a 20-percent increase in prices doesn’t translate into a 20-percent increase in revenue because of lost sales, politicians should understand that higher tax rates don’t mean an automatic and concomitant increase in tax revenue.

This is the infamous Laffer Curve, and it’s simply the common-sense recognition that you should include changes in taxable income in your calculations when trying to measure the impact of higher or lower tax rates on tax revenues.

No, it doesn’t mean lower tax rates “pay for themselves” or that higher tax rates lead to less revenue. That only happens in unusual circumstances. But it does mean that lawmakers should exercise some prudence and judgment when deciding tax policy.

Moreover, even though I’m a strong believer in the importance of good tax policy, it’s also important to understand that taxation is just one of many factors that determine economic performance. So lower tax rates, by themselves, are no guarantee of economic vitality, and higher tax rates don’t necessarily mean the world is coming to an end.

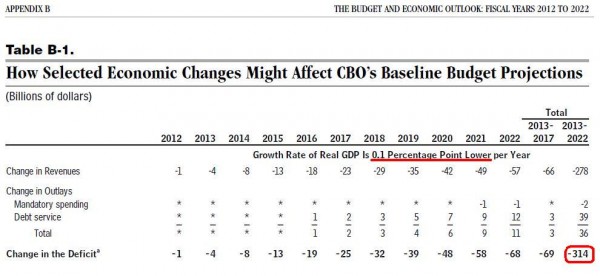

With those caveats in mind, take a look at this table from the Congressional Budget Office’s most recent Budget and Economic Outlook. Taken from page 109, it shows what will happen if the economy grows just a tiny bit less than the baseline projection. Not a recession, by any means, just a drop in the projected growth rate of just 1/10th of 1 percent.

As you can see, the 10-year impact is $314 billion, mostly due to lower tax receipts, though there is some impact on outlays because of higher interest costs and a bit of additional entitlement spending.

So why am I sharing these numbers? Because let’s now think about President Obama’s proposed class-warfare tax hike. He wants higher tax rates on investors, entrepreneurs, small business owners and other “rich” taxpayers. And he wants more double taxation of dividends and capital gains. And a higher death tax rate, even higher than the ones imposed by France and Venezuela.

I think some opponents are exaggerating when they claim that this tax hike will cause a recession and cripple the economy. But I do think that it’s reasonable to contemplate the degree to which the Obama tax hikes will slow growth. More than 1/10th of 1 percent? Less than that? Would the damage occur in the first few years? Would it be spread out over time?

Those questions are hard to answer. Ask five economists and you’ll get nine answers, but there is compelling evidence that higher tax rates do have a negative impact.

But some people assume that taxes don’t matter at all. Using models that, for all intents and purposes, naively assume a simplistic linear relationship between tax rates and tax revenue, the number-crunching bureaucrats in Washington estimate that Obama’s proposed tax hikes will generate about $800 billion over 10 years.

I’m not going to pretend I know the economic impact of those higher tax rates, but for the sake of argument, let’s assume that the impact is minor. Indeed, let’s assume that it’s only 1/10th of 1 percent. Based on the CBO sensitivity analysis above, that means that about 40 percent of the projected deficit reduction will fail to materialize.

And that’s not even considering the fact that politicians will probably increase the burden of government spending because of the expectation of additional tax revenue.

Just something to keep in mind as this debate unfolds.

P.S. I actually shared this exact same data when testifying to the Senate Budget Committee earlier this year. Needless to say, in some cases I think my testimony went in one ear and out the other.

P.P.S. The revenue-maximizing tax rate is not the ideal point on the Laffer Curve.