I write about the Laffer Curve so often that I’m surprised people don’t run away screaming. But I’ll continue to be a pest because I want people to understand that you can’t just look at changes in tax rates when predicting changes in tax revenue. You also have to consider changes in taxable income.

Simply stated, my goal is for people to recognize that higher tax rates lower incentives to earn and report income and lower tax rates increase incentives to earn and report income. However, I also want people to understand that this doesn’t mean “all tax cuts pay for themselves.” That only happens in very rare cases. Moreover, it would be good if people recognized that there are lots of factors that influence the economy’s performance, and it’s therefore important to be cautious when making claims about the relationships between tax rates, taxable income, and tax revenue.

So we many not be able to precisely measure the impact of the Laffer Curve, we know it’s there and we know it can be very significant. We also know that economic incentives are not constrained by national borders. The Laffer Curve exists even in nations where politicians generally are not sympathetic to good tax policy. France naturally comes to mind, and here are some excerpts from a new report from Pierre Garello. He examines recent changes in tax rates and the tax base, and finds that better tax policy is having a positive impact.

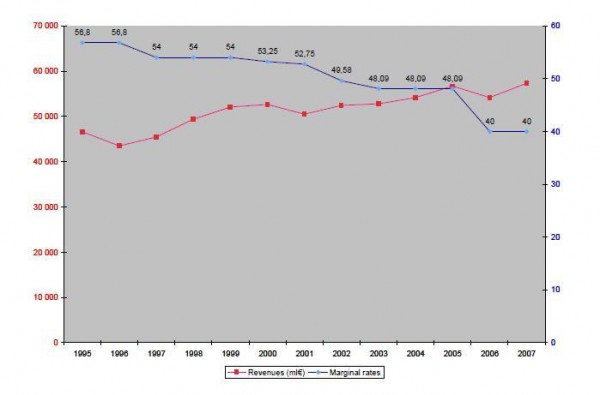

In 2006 a major change was implemented in France regarding the income tax. Not only the top marginal rate was lowered (from 48.09% to 40.00%), but the same treatment was applied to the other rates. Also, the number of brackets was reduced from 7 to 5. As a result, whatever the level of taxable income, the rate applied was lower after the changes took place than before. …the tax base was also enlarged. In particular, while 20% of gross income from salaries was until then automatically deduced to compute the level taxable income, this was no longer the case with income earned in 2006 and after. …Based on data from the French Public Finances General Directorate (DGFiP) we can see that the impact was a minor drop in tax revenues from the 2006 personal income followed by a slightly higher increase in PIT revenues from 2007 earnings. As illustrated by the graph below, the successive cuts in marginal tax rates between 1995 and 2007 have resulted in higher tax revenues.