Richard Rahn writes in the Washington Times today on a pair of regulations which he describes as “national economic suicide.” At issue is the IRS’s proposed regulation that would require U.S. banks to report information on foreign account holders, even though they are not taxed in the U.S., as well as the Foreign Account Tax Compliance Act, an attempt to bully other nations into administering our ill-conceived worldwide tax system, which double taxes U.S. corporations and individuals overseas.

Would you think it is smart to create regulations that make it all but impossible for Americans living abroad to get a bank account in the country where they live? Do you think it makes sense to impose regulations and costs on U.S. financial institutions that would drive needed foreign investment out of the United States for the sole purpose of helping foreign governments collect taxes from their own citizens?

Last week, the Internal Revenue Service (IRS) and U.S. Treasury held a hearing on a proposed regulation that is so dumb and destructive that people had assumed it was buried for good a decade ago, when it originally was proposed…

Former senior U.S. Treasury economic official Stephen J. Entin, president of the Institute for Research on the Economics of Taxation, testified: “The proposed regulation may be good for foreign governments but would not be good for the U.S. economy. There would be no gain for U.S. tax enforcement. Weaker investment in the United States would reduce U.S. jobs and tax revenue beyond any possible reduction in tax evasion affecting money owed to the United States.”

…It gets worse. There is a companion piece to the proposed regulation referred to as the Foreign Account Tax Compliance Act (FATCA) which, according to Treasury, would “require overseas financial institutions to identify U.S. account holders and report account information directly to the IRS, including the account balance.” This provision is nothing less than financial imperialism by the U.S. government, which is trying to regulate and prosecute foreign institutions that are abiding by their own countries’ laws and have a presence in the United States. Already, a number of foreign banks and financial institutions have announced they will no longer accept accounts by U.S. citizens and they will no longer invest in the United States.

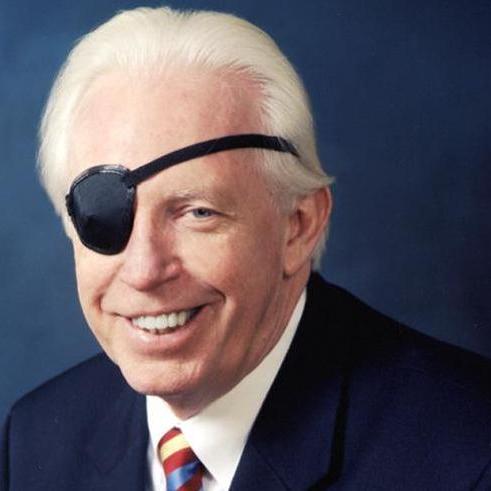

You can read the entire piece, which also includes mention of the testimony provided by CF&P President Andrew Quinlan, here.