Whether I’m criticizing Warren Buffett’s innumeracy or explaining how to identify illegitimate loopholes, I frequently write about the perverse impact of double taxation.

By this, I mean the tendency of politicians to impose multiple layers of taxation on income that is saved and invested. Examples of this self-destructive practice include the death tax, the capital gains tax, and the second layer of tax of dividends.

Double taxation is particularly foolish since every economic theory – including socialism and Marxism – agrees that capital formation is necessary for long-run growth and higher living standards.

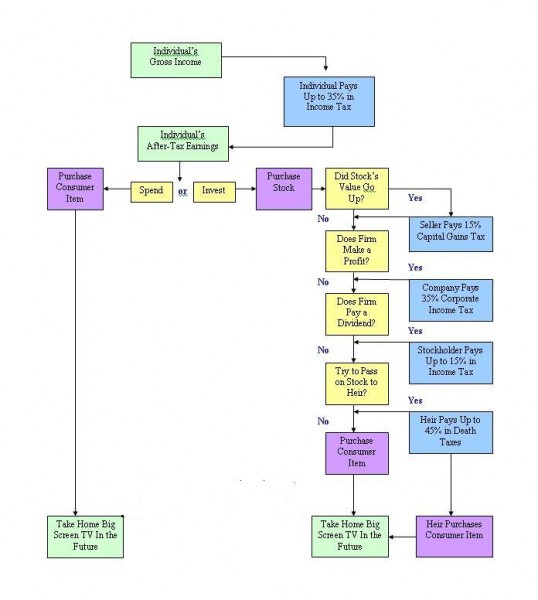

Yet even though this is a critically important issue, I’ve never been satisfied with the way I explain the topic. But perhaps this flowchart makes everything easier to understand (click it for better resolution).

There are a lot of boxes, so it’s not a simple flowchart, but the underlying message hopefully is very clear.

1. We earn income.

2. We then pay tax on that income.

3. We then either consume our after-tax income, or we save and invest it.

4. If we consume our after-tax income, the government largely leaves us alone.

5. If we save and invest our after-tax income, the government penalizes us with as many as four layers of taxation.

You don’t have to be a wild-eyed supply-side economist to conclude that this heavy bias against saving and investment is not a good idea for America’s long-run prosperity.

By the way, Hong Kong’s simple and fair flat tax eliminate all those extra layers of taxation.

That’s the benefit of real tax reform such as a flat tax. You get a low tax rate, but you also get rid of double taxation so that the IRS only gets one bit at the apple.