I testified earlier today before the Joint Economic Committee about budget process reform. As part of the Q&A session after the testimony, one of the Democratic members made a big deal about the fact that federal tax revenues today are “only” consuming about 15 percent of GDP. And since the long-run average is about 18 percent of GDP, we are all supposed to conclude that a substantial tax hike is needed as part of what President Obama calls a “balanced approach” to red ink.

But it’s not just statist politicians making this argument. After making fun of his assertion that Obama is a conservative, I was hoping to ignore Bruce Bartlett for a while, but I noticed that he has a piece on the New York Times website also implying that America’s fiscal problems are the result of federal tax revenues dropping far below the long-run average of 18 percent of GDP.

In a previous post, I noted that federal taxes as a share of gross domestic product were at their lowest level in generations. The Congressional Budget Office expects revenue to be just 14.8 percent of G.D.P. this year; the last year it was lower was 1950, when revenue amounted to 14.4 percent of G.D.P. But revenue has been below 15 percent of G.D.P. since 2009, and the last time we had three years in a row when revenue as a share of G.D.P. was that low was 1941 to 1943. Revenue has averaged 18 percent of G.D.P. since 1970 and a little more than that in the postwar era.

To be fair, both the politician at the JEC hearing and Bruce are correct in claiming that tax revenues this year are considerably below the historical average.

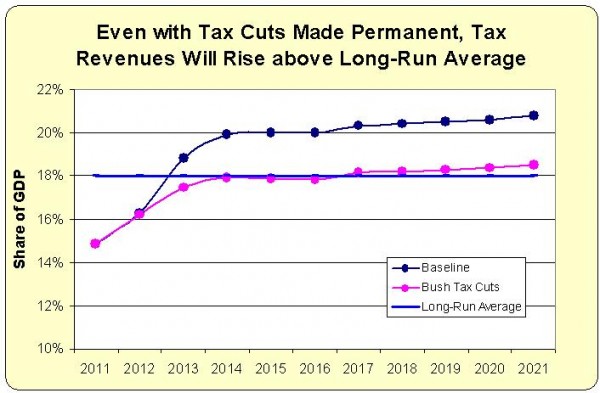

But they are both being a bit deceptive, either deliberately or accidentally, in that they fail to show the CBO forecast for the rest of the decade. But I understand why they cherry-picked data. The chart below shows, rather remarkably, that tax revenues (the fuschia line) are expected to be back at the long-run average (the blue line) in just three years. And that’s even if the Bush tax cuts are made permanent and the alternative minimum tax is frozen.

It’s also worth noting the black line, which shows how the tax burden will climb if the Bush tax cuts expire (and also if millions of new taxpayers are swept into the AMT). In that “current law” scenario, the tax burden jumps considerably above the long-run average in just two years. Keep in mind, though, that government forecasters assume that higher tax rates have no adverse impact on economic performance, so it’s quite likely that neither tax revenues nor GDP would match the forecast.