I’m baffled by stupid Republicans (sorry to be redundant).

Some GOPers have agreed to put taxes on the table. Not surprisingly, Democrats are praising them for this preemptive surrender, patting these Republicans on the head for being good little lapdogs.

(The Democrats are also high-fiving each other since they openly admit that tricking Republicans into a tax hike has been their top political goal, but that’s an issue for another day.)

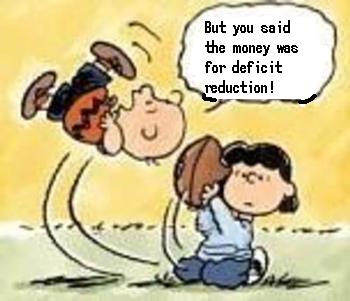

And what are Republicans getting in exchange for violating their no-tax promises? As you might suspect, they’re getting nothing. For all intents and purposes, the left is saying “that’s a good start” and waiting for GOPers to make further concessions.

Needless to say, this is very irritating. And I’m not the only person who is upset. Here is a column that I co-authored along with Grover Norquist, Mike Needham, Phil Kerpen, Al Cardenas, and Duane Parde. We explain why higher taxes are a bad idea.

Some are now suggesting that instead of addressing the real problems our nation faces — by reducing government spending — the supercommittee should recommend tax increases to meet its deficit reduction targets. Tax increases are what politicians always do when they are not willing to govern—that is, to cut and reform government spending. The problem, of course, is that tax hikes crowd out and displace spending reform. …Advocates of…raising taxes…have put forward several unserious arguments. First, they say, “let’s compromise.” Let’s be balanced, they insist, and promise to cut some spending and raise some taxes. Having pushed spending way up, they now want to pretend this spending is normal or, at least, inevitable. It isn’t. …Why should anyone be asked to pay more taxes just so Washington can continue to overspend? …What’s more, there are good reasons to be wary – we’ve been down this road before. In 1982, President Ronald Reagan was promised three dollars of spending cuts for every dollar of tax hikes. The tax hikes were real. But spending — in real dollar terms — went up, not down. In 1990, the same trick was played out — this time at the expense of President George H.W. Bush and the American people. A two-to-one promise brought higher taxes and higher spending. When tax hikes are on the table, the talk about spending cuts evaporates. Oddly enough, the tax hikes remain. The second argument is: “We won’t raise tax rates – we will just reduce deductions and credits.” Nonsense. Closing tax loopholes is all well and good. But doing so to raise revenues is just as much a tax hike as raising tax rates. The tax hike crowd is trying to confuse tax hikes with tax reform. In fact, closing tax loopholes to raise revenue is ultimately antithetical to tax reform — there would then be less revenue available to use to cut tax rates.

As a long-time advocate of the flat tax, I think the second point is very powerful. If you want tax reform, the last thing you should do is let the politicians take away loopholes without using the revenue to finance lower tax rates.

But the most important argument is the first one. Simply stated, higher taxes mean higher spending. Period. End of argument.

If taxes increase $300 billion, that means $300 billion more spending. If taxes increase $600 billion, that means $600 billion more spending.

And since America’s fiscal problem is too much spending, why should we let politicians have more money so they can make government even more bloated and wasteful?