Proponents of higher taxes are fond of claiming that Bill Clinton’s 1993 tax increase was a big success because of budget surpluses that began in 1998.

That’s certainly a plausible hypothesis, and I’m already on record arguing that Clinton’s economic record was much better than Bush’s performance.

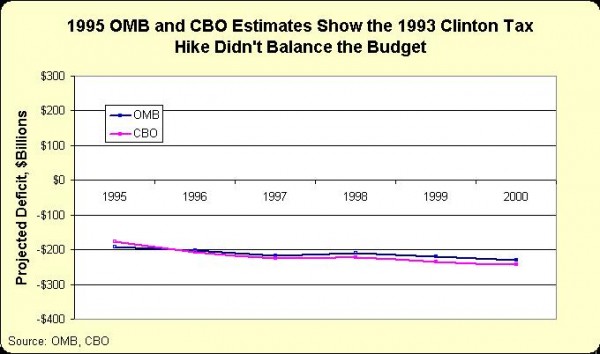

But this specific assertion it is not supported by the data. In February of 1995, 18 months after the tax increase was signed into law, President Clinton’s Office of Management and Budget issued projections of deficits for the next five years if existing policy was maintained (a “baseline” forecast). As the chart illustrates, OMB estimated that future deficits would be about $200 billion and would slightly increase over the five-year period.

In other words, even the Clinton Administration, which presumably had a big incentive to claim that the tax increase would be successful, admitted 18 months after the law was approved that there was no expectation of a budget surplus. For what it’s worth, the Congressional Budget Office forecast, issued about the same time, showed very similar numbers.

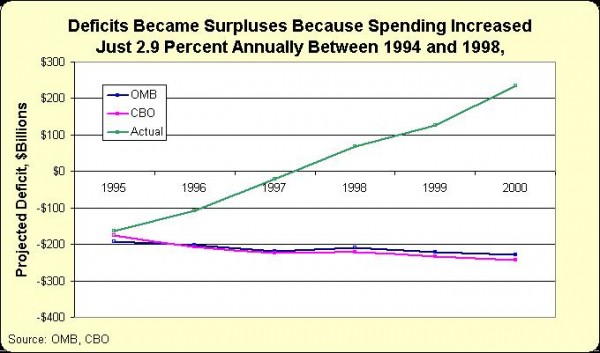

Since the Clinton Administration’s own numbers reveal that the 1993 tax increase was a failure, we have to find a different reason to explain why the budget shifted to surplus in the late 1990s.

Fortunately, there’s no need for an exhaustive investigation. The Historical Tables on OMB’s website reveal that good budget numbers were the result of genuine fiscal restraint. Total government spending increased by an average of just 2.9 percent over a four-year period in the mid-1990s. This is the reason why projections of $200 billion-plus deficits turned into the reality of big budget surpluses.

Republicans say the credit belongs to the GOP Congress that took charge in early 1995. Democrats say it was because of Bill Clinton. But all that really matters is that the burden of federal spending grew very slowly. Not only was there spending restraint, but Congress and the White House agreed on a fairly substantial tax cut in 1997.

To sum things up, it turns out that spending restraint and lower taxes are a recipe for good fiscal policy. This second chart modifies the first chart, showing actual deficits under this small-government approach compared to the OMB and CBO forecasts of what would have happened under Clinton’s tax-and-spend baseline.