I just read something that unleashed my inner teenager, because I want to respond with a combination of OMG, LMAO, and WTF.

Donald Berwick, the person appointed by Obama to be in charge of Medicare, has a column in the Wall Street Journal that makes a very good observation about how relative prices are falling for products bought and sold in the free market. But he then draws exactly the wrong conclusion by asserting that further crippling market forces for healthcare will yield similar cost savings for programs such as Medicare.

Here’s the relevant passage from his Wall Street Journal column.

The right way is to help bring costs down by making care better and improving our health-care system. Improving quality while reducing costs is a strategy that’s had major success in other fields. Computers, cars, TVs and telephones today do more than they ever have, and the cost of these products has consistently dropped. The companies that make computers and microwaves didn’t get there by cutting what they offer: They achieved success by making their products better and more efficient. …Under President Obama’s framework, we will hold down Medicare cost growth, improve the quality of care for seniors, and save an additional $340 billion for taxpayers in the next decade.

I have no idea whether Berwick realizes that he has inverted reality, so I can’t decide whether he is cynically dishonest or hopelessly clueless. All I can say with certainty is that what he wrote is sort of like asserting “gravity causes things to fall, so therefore this rock will rise when I let go of it.”

To explain, let’s start by looking at why relative prices are falling for computers, cars, TVs and telephones. This isn’t because the companies that make these products are motivated by selflessness. Like all producers, they would love to charge high prices and get enormous profits. But because they must compete for consumers who are very careful about getting the most value for their money, the only way companies can earn profits is to be more and more efficient so they can charge low prices.

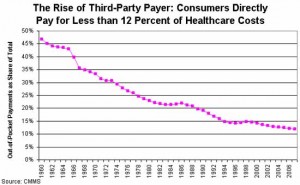

So why isn’t this happening in health care? The answer, at least in part, is that consumers aren’t spending their own money so they don’t really care how much things cost . As this chart illustrates (click to enlarge), only 12 percent of every healthcare dollar is paid directly by consumers. The rest comes from third-party payers, mostly government but also insurance companies.

. As this chart illustrates (click to enlarge), only 12 percent of every healthcare dollar is paid directly by consumers. The rest comes from third-party payers, mostly government but also insurance companies.

In other words, Berwick’s column accidentally teaches us an important lesson. When consumers are in charge and responsible for paying their own bills, markets are very efficient and costs come down. But when government policies cause third-party payer, consumers have little if any incentive to spend money wisely – leading to high costs and inefficiency.

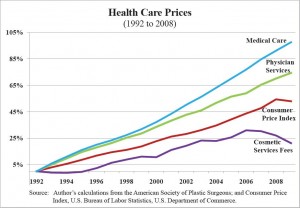

Defenders of the status quo argue that the market for healthcare somehow is different than the market for things such as computers. But here’s a chart (click to enlarge) showing that relative prices are falling in one of the few areas of the healthcare system where consumers spend their own money. And I’ve previously noted that the same thing applies with abortion, where prices have been remarkably stable for decades. Regardless of one’s views on the procedure, it does show that costs don’t rise when people spend their own money.

Defenders of the status quo argue that the market for healthcare somehow is different than the market for things such as computers. But here’s a chart (click to enlarge) showing that relative prices are falling in one of the few areas of the healthcare system where consumers spend their own money. And I’ve previously noted that the same thing applies with abortion, where prices have been remarkably stable for decades. Regardless of one’s views on the procedure, it does show that costs don’t rise when people spend their own money.

That’s common sense and basic economics. But it’s not a good description of Obama’s healthcare plan, which is explicitly designed to increase the share of medical care financed by third-party payer.

The White House presumably would argue that price controls will help control costs. And the President’s Independent Payment Advisory Board (a.k.a., the death panel) will have enormous power to directly or indirectly restrict care, but that’s probably not too comforting for the elderly and others with high healthcare expenses.

The right approach, needless to say, would be to restore market forces to healthcare, which is the core message of this video narrated by Eline van den Broek of the Netherlands.