At his press conference today, President Obama repeatedly said that a “balanced approach” is needed to deal with the fiscal situation.

The White House has obviously poll-tested and focus-grouped that phrase. But just because it’s gimmicky, that doesn’t mean balance is a bad idea. So I’ve decided to take the President’s challenge.

I want to know why America’s fiscal situation is so out of whack. I’m willing to take a dispassionate look at the numbers. And if those figures show that the President is right, and that “unaffordable tax cuts” have caused higher deficits, then I’m willing to support higher revenues (after all, I am a pragmatic, middle-of-the-road guy).

My first step was to go the White House website and track down the historical data from the President’s Office of Management and Budget.

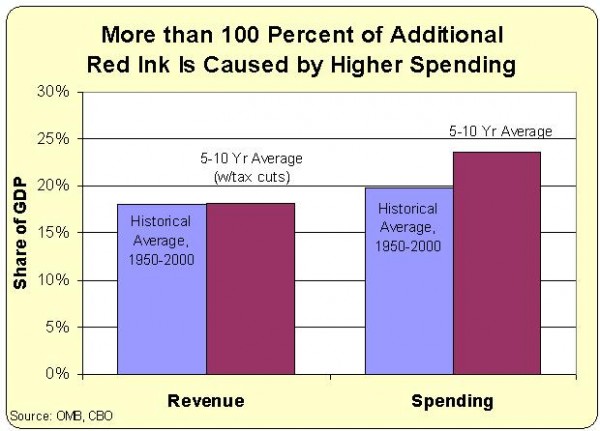

Those numbers show that federal spending, on average, consumed 19.8 percent of GDP from 1950-2000.

Tax revenues, by contrast, have consumed an average of 18 percent of GDP.

If my math is correct, that means deficits averaged almost 2 percent of GDP over that period.

To determine why deficits are higher today than that long-run average, I decided to look at what spending and revenues will be over the next 5-10 years. I could have picked this year, but that seemed unfair since the economy is still weak, which causes abnormally high spending and unusually low revenue.

Moreover, the spending figures would be artificially high because of wars that we are told are soon coming to an end.

Additionally, everyone is talking about 10-year plans, not fixing the problem overnight, so looking at the 5-10 year figures makes sense.

And, to expose any smoke-and-mirrors by the GOP, I also will assume the 2001 and 2003 tax cuts are made permanent. That way, we’ll know the degree to which Bush’s tax cuts are responsible for additional red ink.

So I went to the Congressional Budget Office and found the relevant data (Tables 1.1 and 1.2, along with Table 1.7).

I discovered that tax revenues between 2016 and 2021 will average about 18.2 percent of GDP. And that’s assuming, as just noted, the 2001 and 2003 tax cuts are made permanent.

I also found that the burden of federal spending will average about 23.6 percent of GDP during that same period.

So let’s see what we should do if we want to satisfy the President’s demand for a balanced approach…hmm…

Tax revenues will be 18.2 percent of GDP, slightly higher than their historical average of 18.0 percent of economic output. So we can safely conclude that revenues in general (and “unaffordable tax cuts” in particular) are not responsible for higher levels of red ink.

Now let’s look at the outlay side of the fiscal ledger. Federal spending is projected to consume about 23.6 percent of GDP, substantially higher than the long-run average of 19.8 percent of economic output.

In other words, if we want to assign blame for higher deficits, the increase in federal spending deserves more than 100 percent of that blame.

Which implies, if we want to be balanced, that spending restraint should be more than 100 percent of the solution.

Here’s a chart based on those OMB and CBO numbers.

By the way, lest anyone think that I cherry picked historical data, I deliberately decided not to use 1946-2010 data, which would have made my point even stronger. Over that longer period of time, revenues average 17.7 percent of GDP and spending averaged 19.7 percent of GDP.

However you slice the numbers, America’s fiscal policy problem is too much spending. The solution, as I explain here, is to limit the growth of the federal budget.